Educational technology provider Alef Education is planning to raise up to $515 million in its initial public offering (IPO) on the Abu Dhabi stock market, as announced on Tuesday (May 28). The indicative price range for the IPO has been established at 1.30-1.35 dirhams per share, suggesting a market capitalisation of $2.48 billion-2.57 billion, according to a statement released by the company. Alef stated that shareholders Tech Nova Investment, Sole Proprietorship, and Kryptonite Investments intend to offer 1.4 billion shares, representing 20% of its share capital. The shares are anticipated to commence trading on June 12.

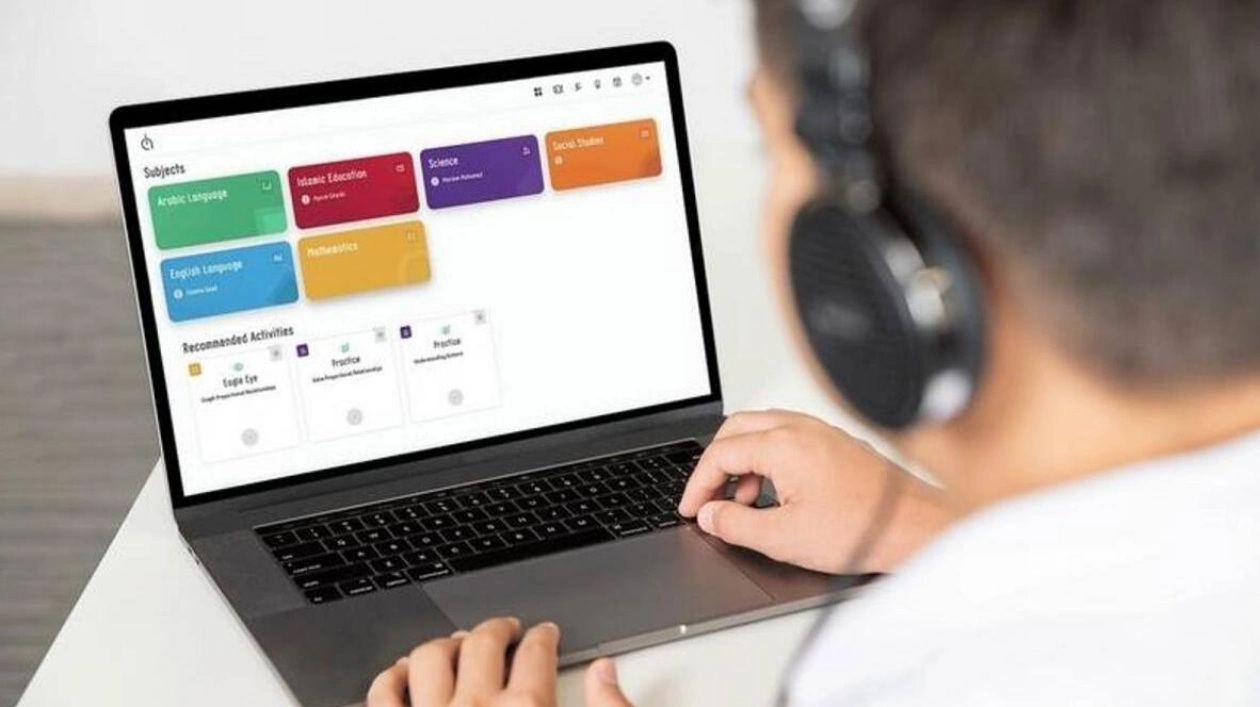

Established in 2016, Alef offers artificial intelligence (AI)-powered and personalized learning programs and has a platform that caters to approximately 1.1 million registered students, 50,000 teachers, and 7,000 schools as of the close of last year. Alef's IPO comes in the wake of education firms such as Taaleem Holdings being listed in the region in recent years. Amanat Holdings revealed earlier this month that it was exploring options for its education platform, including the possibility of an IPO.