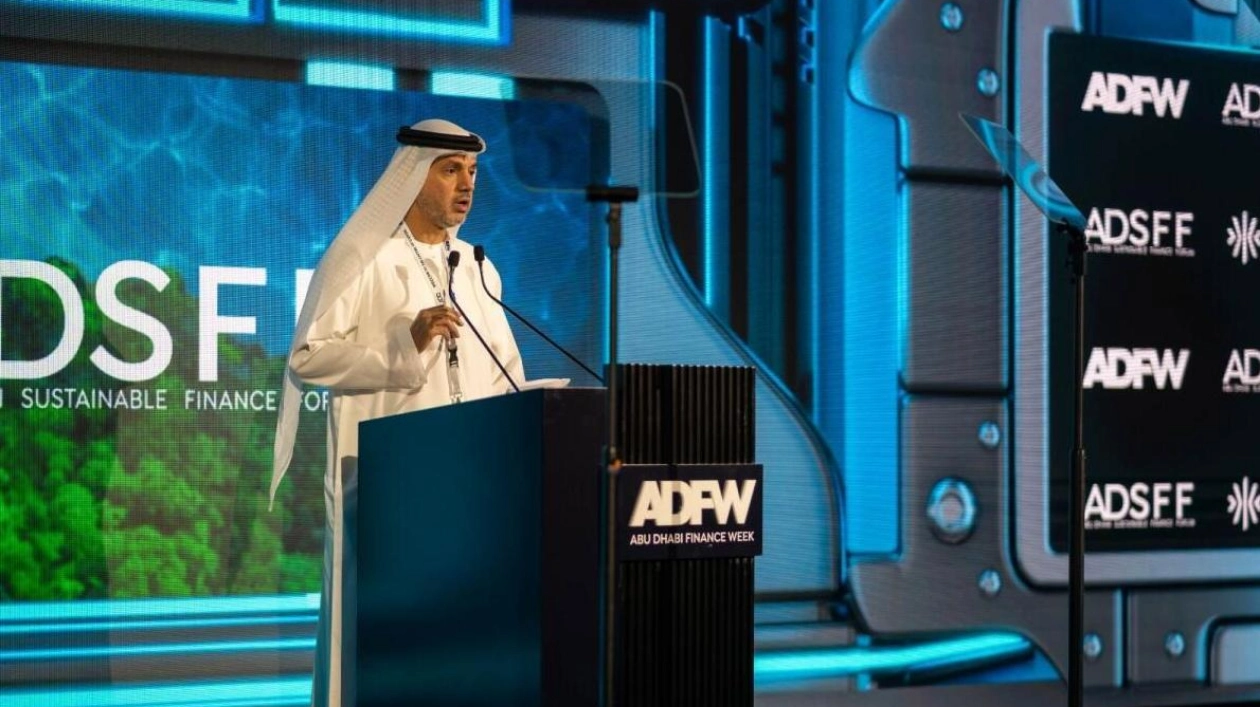

Fahad Al Qassim, Director General of Awqaf Abu Dhabi, announced the launch of a specialized investment company, Awqaf Capital, during Abu Dhabi Finance Week (ADFW). The company aims to maximize the revenue and utilization of endowments by expanding the sector to include health, educational, and social projects. Operations are set to commence in the first quarter of 2025.

"Awqaf Capital will serve as the investment arm of Awqaf Abu Dhabi, managing endowments—both cash and assets—and conducting investments within the UAE and internationally to enhance their profitability and sustainability for beneficiaries," explained Fahad Al Qassim.

Since its establishment in May last year, Awqaf Abu Dhabi has been overseeing the emirate's endowed assets and monetary funds previously managed by the federal General Authority of Islamic Affairs and Endowments. Al Qassim highlighted that these endowments often lack proper governance and expertise, limiting their potential revenue and impact. For instance, endowed properties should be evaluated by experts to determine their market value based on factors like age, profit earned, and optimal use.

"Currently, this is not happening," said Al Qassim, citing an example of waqf villas rented for AED 200,000 but worth much more. "We recently rented them for AED 800,000, quadrupling the value."

Awqaf Abu Dhabi is broadening the scope of endowments beyond traditional Islamic projects, such as building mosques, wells, and charitable centers. "Endowments encompass far more than that," Al Qassim emphasized. Most endowments inherited from the federal authority focus on religious initiatives due to a limited understanding of their broader potential. "Our mission is to redefine endowments in the community, making them applicable to any charitable project that benefits society, health, and academia."

Al Qassim mentioned a AED 1-billion healthcare investment fund launched by his authority in May, aiming to optimize revenues and benefits over five years. Profits will be reinvested in healthcare projects, from patient treatment to hospital construction if necessary.

While Awqaf Abu Dhabi is already investing in registered endowments, the objective is to establish an investment fund managed by Awqaf Capital. "We must handle endowed money, especially for minors, with care to ensure its sustainability during financial crises," Al Qassim noted. "Investing in defensive sectors like education, health, food, and infrastructure is crucial as they remain essential regardless of economic conditions."

The ultimate goal is to ensure endowments are charitable, sustainable, and beneficial to society, whether religious or not. Additionally, Awqaf Abu Dhabi plans to launch a family endowments branch to manage assets designated as endowments for heirs. "Currently, 70% of inherited fortunes are lost between the first generation of heirs," Al Qassim stated. The new framework will enforce strict governance to protect family fortunes from diminishing.

Al Qassim highlighted that family endowments are common in the West as 'family foundations'. This will be a new market for the authority, as no such endowments have been registered to date.

Source link: https://www.khaleejtimes.com