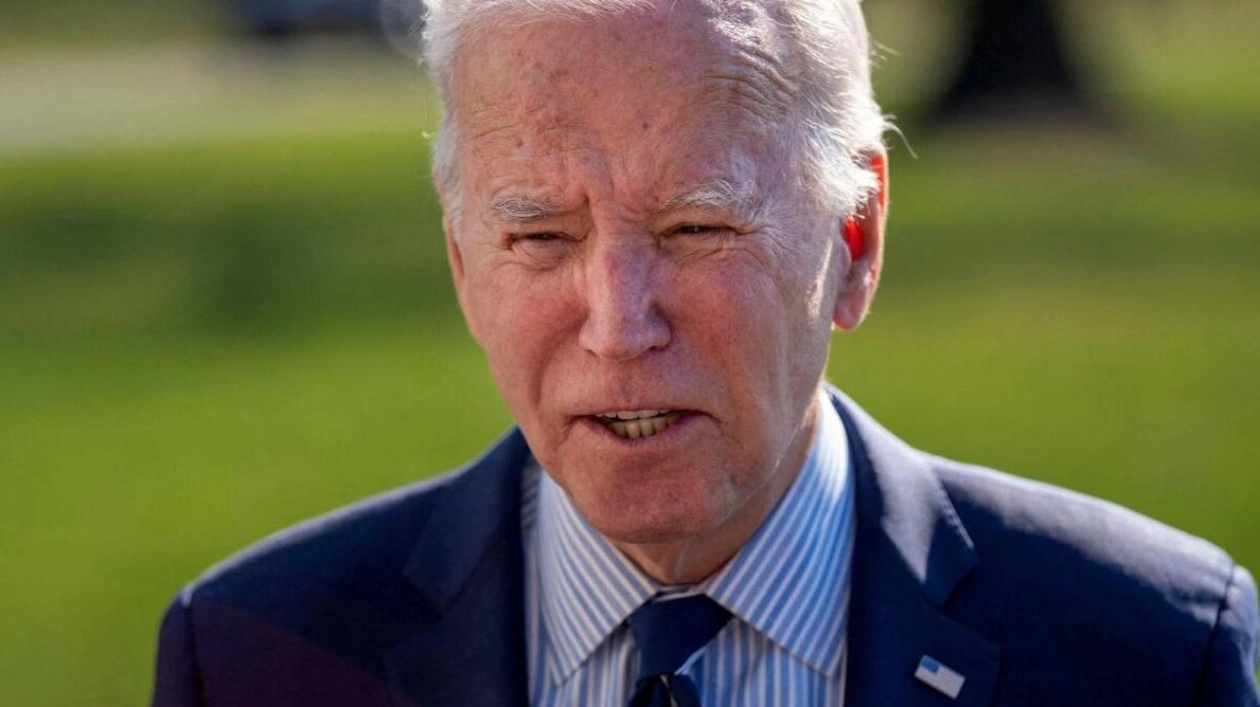

US President Joe Biden's cautious stance on corporate mergers has characterized his administration's business policy, a position generally anticipated to soften if Donald Trump reclaims the White House. Biden's appointees, such as Lina Khan, chair of the Federal Trade Commission, and assistant attorney general Jonathan Kanter, have expanded government antitrust oversight to include factors like a deal's effect on workers and potential market newcomers. Dealmakers have voiced concerns about increased costs due to this intensified scrutiny, although Khan and Kanter maintain they have prevented problematic deals. As Biden's term winds down, the antitrust and dealmaking communities are considering the future implications as voters evaluate the candidacies of Vice President Kamala Harris and former President Donald Trump. A Trump victory is widely believed to lead to less antitrust enforcement and more deal activity compared to a Harris win, though this is not guaranteed, given the diverse interests within today's Republican coalition, including Trump's running mate Senator JD Vance, who has expressed support for Khan. "There's a lot of uncertainty," noted New York University Professor Harry First, adding that the populist leanings of some Trump coalition members make predicting outcomes difficult. A Wall Street banker, who requested anonymity, forecasted a Trump win as "slightly positive to very positive" for dealmaking, but cautioned that optimism should be moderated by concerns over a potential resurgence of the US-China trade war. Biden initiated a confrontational approach to dealmaking early in his presidency, criticizing the excessive consolidation by large companies. His July 2021 executive order promoted competition and strengthened antitrust enforcement, reflecting a departure from the past 40 years' policy of allowing corporations to amass power. Khan's appointment signaled a clear shift in approach, particularly to the tech industry. Her rise to prominence came after a 2017 academic piece on Amazon, which criticized antitrust enforcement for neglecting issues like worker impact and the potential of non-monopoly big companies to stifle competition. Khan and Kanter have emphasized these concerns, notably in the December 2023 finalized merger guidelines. They have achieved some legal victories, such as reversing Illumina's acquisition of Grail and ruling Google's search engine as a monopoly, but have also faced significant defeats, including challenges to Microsoft's acquisition of Activision Blizzard and UnitedHealth Group's takeover of Change Healthcare. Former FTC enforcement official Ryan Quillian noted that the current commission has filed fewer lawsuits than its predecessors, suggesting that the Biden administration's enforcement actions may not match its rhetoric. Quillian, now a partner at Covington & Burling, observed that agencies are using rhetoric and procedural tactics to discourage mergers. CEOs now consider the likelihood of antitrust enforcement early in deal negotiations, according to a Wall Street banker, who added that clients are more cautious about potential deals. The American Investment Council, representing the private equity industry, has strongly opposed a Biden administration proposal to enhance pre-merger notification disclosures. The proposed amendments to the Hart-Scott-Rodino Act would require detailed information about transaction rationales, projected revenues, and corporate relationships, potentially increasing deal costs and slowing the economy. These changes await finalization, and the next administration will need to decide on their implementation, along with the 2023 merger guidelines, which require court adoption to be effective. Other considerations include ongoing lawsuits against tech giants like Apple, Amazon, Google, and Meta, and whether to pursue litigation, settle, or dismiss these cases.

Text: Lara Palmer

26.08.2024

Dealmaking and Antitrust Enforcement in the Balance with Upcoming Election