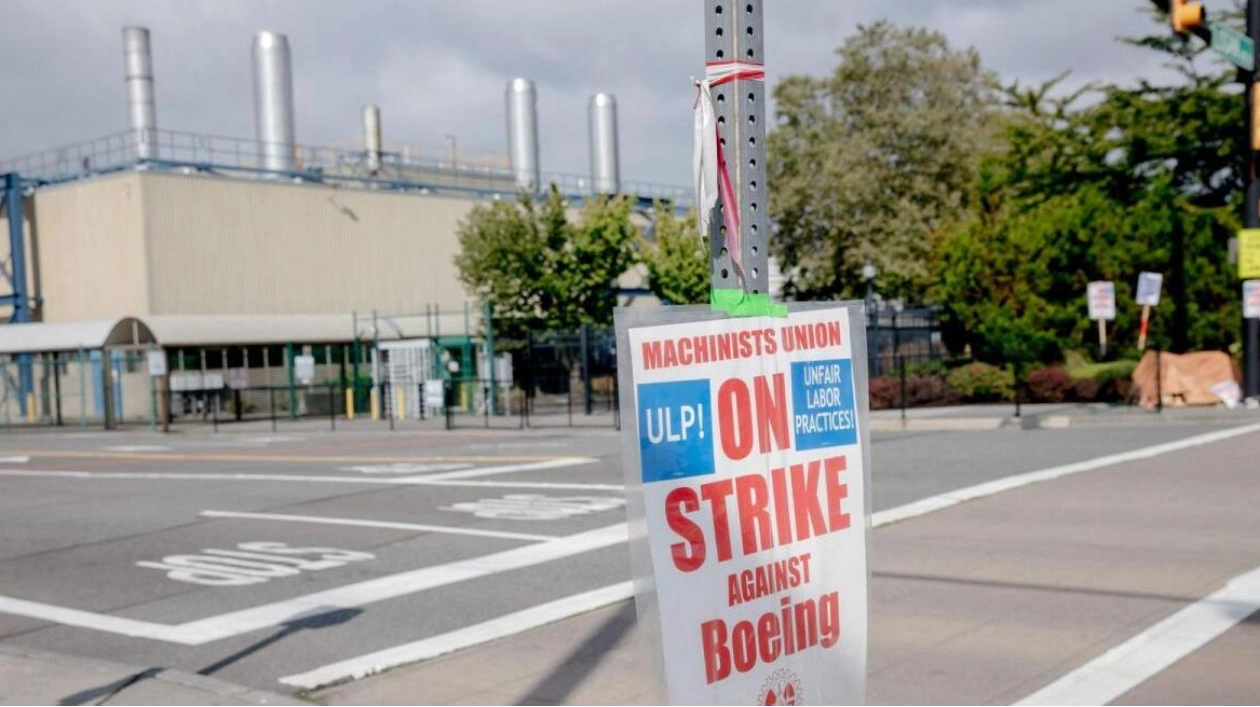

Boeing and its largest union are set to resume contract negotiations on Wednesday, with federal mediators present, after failing to reach an agreement on crucial issues such as wages and pensions, according to the International Association of Machinists and Aerospace Workers. The union, whose members went on strike last Friday, has been advocating for a 40% raise over four years in its first full contract negotiations with Boeing in 16 years, significantly higher than the planemaker's offer of 25%, which was overwhelmingly rejected. Analysts warn that a prolonged strike could cost Boeing several billion dollars, exacerbating the planemaker's financial strain and potentially leading to a downgrade of its credit rating.

"After a full day of mediation, we are frustrated, the company was not prepared and was unwilling to address the issues you've made clear are essential for ending this strike: Wages and Pension," the union representing over 30,000 Boeing factory workers stated on X following Tuesday's meeting. "The company doesn't seem to be taking mediation seriously. With a 96% strike vote, we thought Boeing would finally understand that IAM 751 Machinists are demanding more. We are fighting for what is right and just - for what we have earned over the past 16 years," it added.

The strike, which enters its sixth day on Wednesday, marks Boeing's first since 2008 and is the latest in a series of challenges for the planemaker, which began with a January incident where a door panel detached from a new 737 MAX jet mid-air. Boeing and the U.S. Federal Mediation & Conciliation Service did not immediately respond to emails seeking comment outside normal business hours. The strike has halted production of Boeing's best-selling 737 MAX jets, along with its 777 and 767 widebody aircraft, delaying deliveries to airlines.

Boeing announced on Monday that it was freezing hiring and considering temporary furloughs to cut costs, as its balance sheet is already burdened with $60 billion of debt. A prolonged strike could further damage its financial health. The company has also halted most orders for parts for all Boeing jet programs except the 787 Dreamliner, a move that will negatively impact its suppliers. Shares have fallen approximately 40% this year.