China's economic growth in the second quarter was significantly lower than anticipated, as prolonged issues in the property sector and job insecurity hindered a fragile recovery, fueling expectations that Beijing may need to implement additional stimulus measures. Official figures revealed that the world's second-largest economy expanded by 4.7% in the period from April to June, marking the slowest growth since the first quarter of 2023 and falling short of the 5.1% forecast by analysts in a Reuters survey. This growth rate also decelerated from the 5.3% increase recorded in the previous quarter.

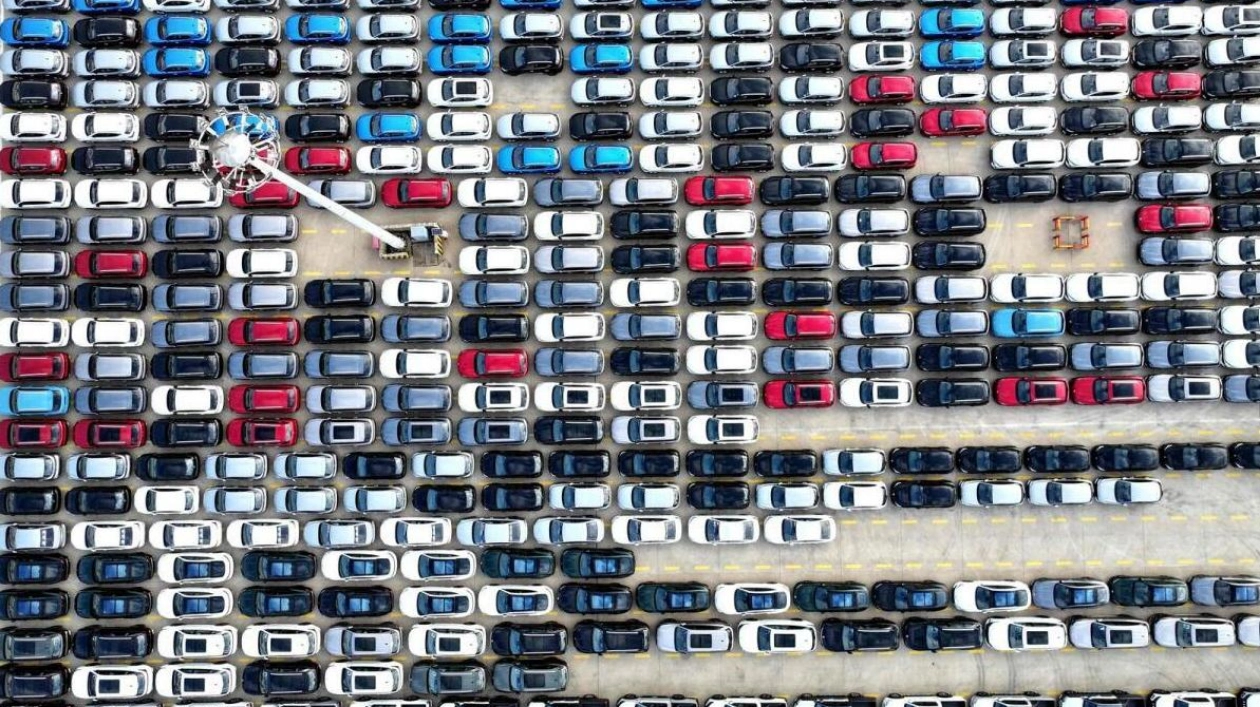

Particularly concerning was the performance of the consumer sector, where retail sales growth reached an 18-month low due to deflationary pressures compelling businesses to reduce prices across various products, from automobiles to food and clothing. Lynn Song, chief economist for Greater China at ING, commented that the underwhelming GDP data indicates that achieving the 5% growth target remains a formidable challenge. He noted that a negative wealth effect from declining property and stock prices, coupled with minimal wage growth amid cost-cutting measures across various industries, is dampening consumer spending and shifting focus from major purchases to basic necessities.

The ongoing property crisis intensified in June, with new home prices experiencing the sharpest decline in nine years, which has eroded consumer confidence and limited the ability of debt-burdened local governments to raise new funds through land sales. Analysts anticipate that reducing debt and boosting confidence will be the primary focus of an upcoming economic leadership meeting in Beijing, although addressing one of these issues could complicate efforts to resolve the other. The government is targeting an economic growth rate of approximately 5.0% for 2024, a goal that many analysts consider ambitious and likely requiring further stimulus.

Harry Murphy Cruise, economist at Moody's Analytics, stated that the remainder of 2024 will hinge on officials' ability to stabilize the property market and stimulate domestic spending. On a quarterly basis, growth stood at 0.7%, down from a revised 1.5% in the preceding three months, according to data from the National Bureau of Statistics (NBS). To counteract weak domestic demand and the property crisis, China has increased investment in infrastructure and injected funds into high-tech manufacturing. Following the disappointing data, China's yuan and stocks declined.

The NBS acknowledged that while adverse weather contributed to the slowdown in the second quarter, the economy faces increasing external uncertainties and internal challenges in the second half. China's economic growth has been uneven, with industrial output surpassing domestic consumption, exacerbating deflationary risks amidst the property downturn and rising local government debt. Despite robust Chinese exports providing some support, escalating trade tensions now pose a threat. Factory output growth exceeded expectations in June but still slowed compared to May, according to separate data released on Monday.

Retail sales, however, were a significant concern, rising only 2.0% year-on-year and missing forecasts, marking the slowest growth since December 2022. Xing Zhaopeng, senior China strategist at ANZ, highlighted the weak retail sales among the monthly figures released. He noted that household consumption remains feeble due to salary cuts and high youth unemployment, suggesting that households will remain cautious in the future. Property investment decreased by 10.1% in the first half of 2024 compared to the same period last year, and home sales by floor area declined by 19.0%.

Bank lending data for June indicated a weakening demand, with some key indicators reaching record lows. To support growth, China's central bank governor recently pledged to maintain a supportive monetary policy stance. Analysts surveyed by Reuters predict a 10-basis point cut in China's one-year loan prime rate and a 25-basis point cut in banks' reserve requirement ratio in the third quarter. Citi analysts expect the government to introduce another round of property-supporting measures following a Politburo meeting expected in late July.

Authorities in May permitted local state-owned enterprises to purchase unsold completed homes, with the central bank establishing a 300 billion yuan relending facility for affordable housing. Moody's Analytics' Murphy Cruise commented that while the need for reform is evident, it is unlikely to be particularly exciting. He added that significant policy shifts could be perceived as an admission of failure and a way to lose face, and assuming modest reforms, China may just manage to meet its 'around 5%' growth target for the year.