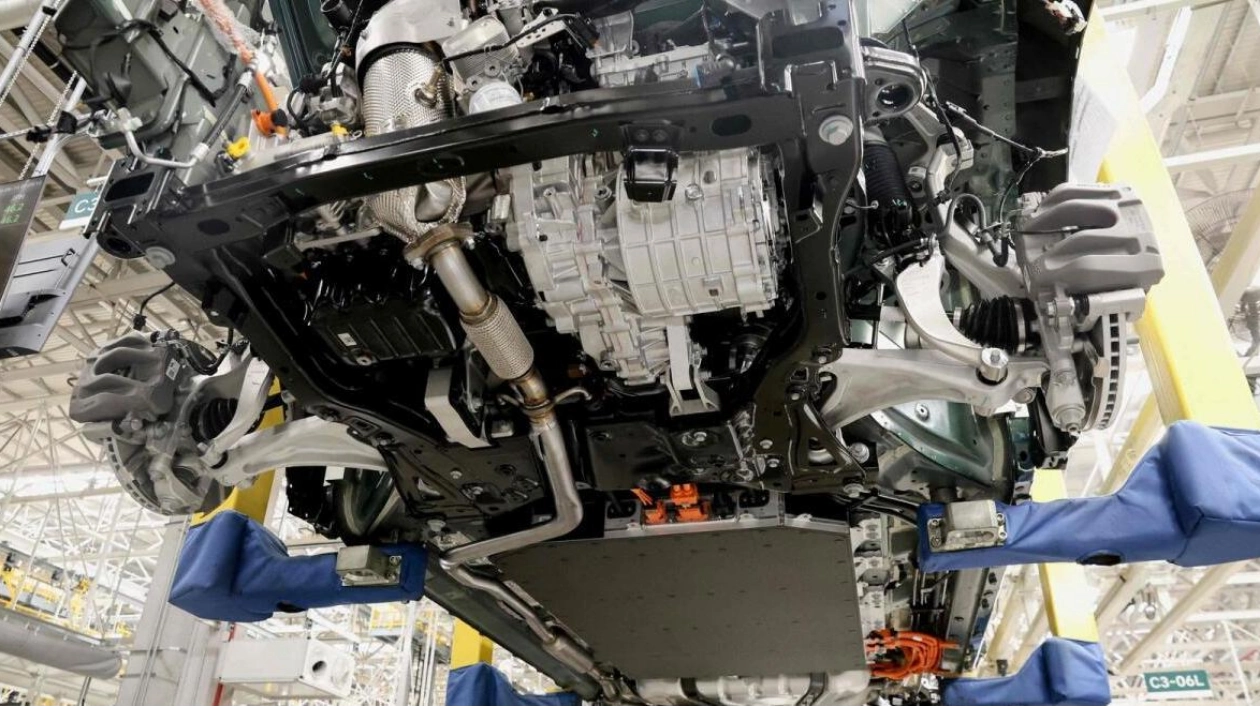

China's industrial output for May fell short of expectations, and the property sector slowdown showed no signs of easing despite government support, putting more pressure on Beijing to stimulate growth. Retail sales, however, exceeded forecasts due to a holiday boost. The data released on Monday was mostly negative, highlighting a challenging recovery for the world's second-largest economy. Industrial output increased by 5.6% year-on-year, down from 6.7% in April and below the expected 6.0% increase according to a Reuters poll. Conversely, retail sales, a measure of consumption, rose by 3.7% year-on-year, accelerating from 2.3% in April and marking the fastest growth since February, attributed to a five-day public holiday. Goldman Sachs analysts noted significant cross-sector divergences in the economy, with strong exports and manufacturing, stable consumption, and depressed property activity. Fixed asset investment rose by 4.0% in the first five months of 2024 compared to the previous year, missing expectations of a 4.2% rise. Manufacturing investment grew robustly by 9.6%, supported by China's focus on 'quality growth' through technological advancements and innovation. However, economists warn that rising trade tensions with the West over China's overcapacity could pose challenges to its solar and electric vehicle sectors. Private sector investment grew by only 0.1% in January-May, indicating weak confidence among private businesses, contrasting with a 7.1% jump in state sector investment. Asian markets reacted negatively to the mixed data, with the Chinese blue chip CSI300 index falling by 0.2%. Exports significantly drove industrial growth and manufacturing investment, but the real estate slump continued to impact household consumption and investment. The property market, high local government debt, and deflationary pressures remain significant drags on economic activity, prompting calls for more fiscal and monetary support. The central bank maintained a key policy rate unchanged, but there is a likelihood of a cut to the Loan Prime Rate, particularly for the 5-year tenor, to help banks retain mortgage loans. Property investment fell by 10.1% year-on-year in January-May, worsening from a 9.8% decline in January-April, and new home prices dropped by 0.7% in May from April, marking the steepest decline since October 2014. The property sector, which previously accounted for about a quarter of economic output, has been affected by regulatory crackdowns and broader economic pressures. The government has implemented measures to aid homebuyers, but weak domestic demand continues to suppress consumer prices and confidence remains low amid the ongoing property crisis. New bank lending in May rebounded less than expected, and some key money indicators hit record lows. The job market remained stable, with the nationwide unemployment rate at 5.0% in May, unchanged from April. Beijing has committed to creating more jobs related to major projects, boosting domestic demand, and increasing fiscal stimulus to support growth.

Text: Lara Palmer

17.06.2024

Despite Policy Support, Property Sector Continues to Struggle, Pressuring Beijing to Boost Growth