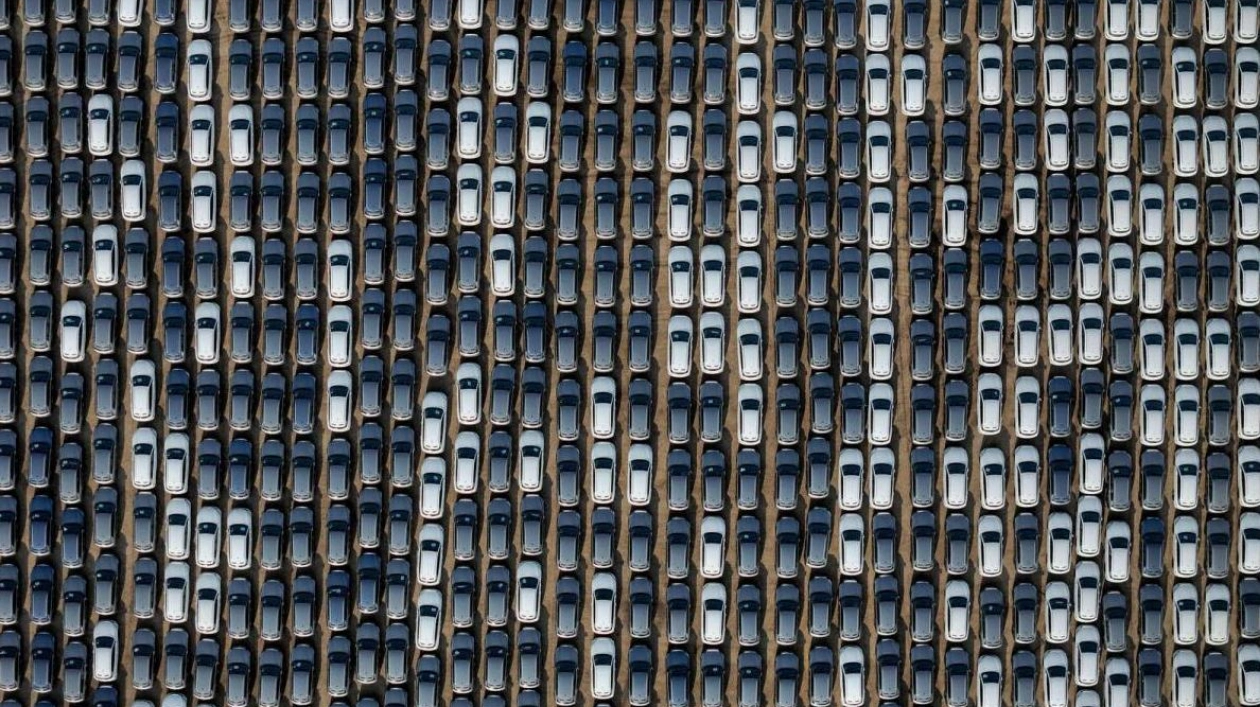

Electric cars for export are seen being loaded onto a ship at a port in Yantai, eastern China. — AFP

China's exports experienced a significant slowdown in November, while imports unexpectedly contracted, raising concerns about the world's second-largest economy as Donald Trump's return to the White House introduces new trade risks. The disappointing trade data follows other indicators suggesting uneven growth in November, indicating that Beijing needs to take further steps to stabilize its struggling economy, which is likely to face more challenges in the coming year.

According to customs data released on Tuesday, outbound shipments grew by 6.7% last month, falling short of the forecasted 8.5% increase and significantly lower than the 12.7% growth in October. More worryingly, imports shrank by 3.9%, marking their worst performance in nine months and missing expectations for a 0.3% rise. This has renewed calls for additional policy support to boost domestic demand.

On Monday, top leaders pledged to ramp up stimulus measures by 2025, adopting a more accommodative stance on monetary and fiscal policies to stimulate demand and encourage consumer spending. "Global demand is not particularly strong, and data from major exporters like South Korea and Vietnam also show varying degrees of slowdown," said Xu Tianchen, senior economist at the Economist Intelligence Unit. "Early signs of trade frontloading in anticipation of Trump's tariffs next year have begun to emerge, but the full impact will only be felt in the coming months, especially in December and January," he added.

US President-elect Trump has vowed to impose an additional 10% tariff on Chinese goods, aiming to pressure Beijing to curb the trafficking of chemicals used in fentanyl production. His previous threats of tariffs exceeding 60% have already unsettled China's industrial sector, which exports over $400 billion worth of goods to the US annually. In anticipation of potential tariff hikes, exporters rushed to move stock to US warehouses in October, expecting new orders once global demand picks up. Although this trend slowed in November, frontloading ahead of anticipated tariffs may still support exports.

"We anticipate exports to pick up again in the coming months, driven by improvements in export competitiveness and exporters front-running tariffs," said Zichun Huang, China economist at Capital Economics. However, ongoing tensions with the European Union over tariffs as high as 45.3% on Chinese-made electric vehicles could escalate Beijing's trade conflict with the West.

China's trade surplus rose to $97.44 billion last month, up from $95.72 billion in October. The US tariffs pose a greater threat to China than during Trump's first term, as the $19 trillion economy heavily relies on exports, which are now under pressure due to a prolonged property crisis affecting household and business confidence. Although manufacturers reported the best business conditions in seven months in a November factory survey, they also noted a decline in export orders.

These trends have led analysts and policy experts to call for a shift away from over-reliance on manufacturing and exports. Government advisors recommend maintaining the growth target at around 5% next year and implementing stronger stimulus measures to mitigate the impact of expected US tariffs by leveraging the domestic consumer market. In response to economic challenges, China's central bank introduced its most aggressive monetary easing since the pandemic in September, cutting interest rates and injecting 1 trillion yuan ($140 billion) into the financial system.

China also saw significant declines in imports of commodities such as vegetable oils, rare earths, and fertilizers, partly due to falling commodity prices, which also helped increase volumes for crude oil, coal, and copper. Top policymakers are expected to meet this week to set key targets and policy directions for next year. Investors will be closely monitoring any indications that Beijing will prioritize the consumer sector in its policies, moving away from its focus on upgrading export-reliant manufacturing.

Economists predict that China's imports will recover in the coming months, especially as policymakers are expected to expand fiscal spending next year. "Robust fiscal expenditure, likely directed toward investment, should boost demand for industrial commodities in the coming months," said Capital Economics' Huang.

Source link: https://www.khaleejtimes.com