On Tuesday, China's stocks faced difficulties in gaining momentum, even as regional markets showed signs of recovery. Investors continued to express concerns over the country's slow economic recovery. The Chinese stock market had dropped by over 1% in the prior session, but this decline was significantly less severe compared to other regional markets. Analysts attribute this to the Chinese market's relative isolation from the global downturn due to its underperformance.

By midday, China's CSI 300 Index had decreased by 0.2%, following an initial rise of 0.7%, while Hong Kong's Hang Seng Index increased by 0.5%. Xia Haojie, an analyst at Guosen Futures in Shenzhen, noted that the impact on China's stocks was minimal as they were already at low levels and somewhat insulated from global market volatility. He also mentioned that many foreign investors had already exited China, and those who had incurred significant paper losses were unlikely to sell further.

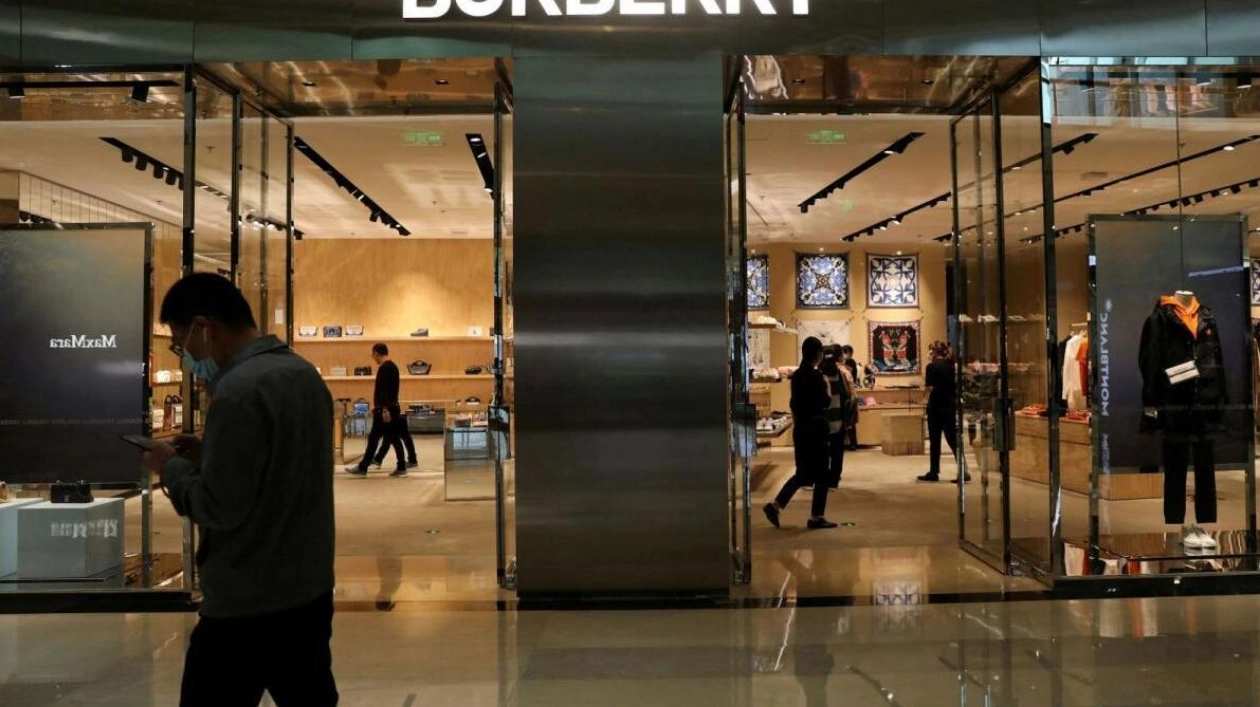

Investors remain focused on China's lagging growth, especially after the country's second-quarter economic expansion fell short of expectations, affected by deflationary pressures and a prolonged slump in the property sector. Retail sales growth in June reached its lowest point since early 2023. Christopher Ying, an investment manager at Shanghai Ju Cheng Asset Management Co, stated that despite the global market turmoil, China is not seen as a safe haven due to its unstable economic fundamentals. In sectoral terms, China's financial sector index fell by 0.98%, while the real estate index rose by 1.05%. In Hong Kong, tech stocks increased by 0.9%.

Regionally, Japanese stocks made significant gains at the start of Tuesday's trading, almost recovering from Monday's losses, part of a broader rebound in Asian markets. This recovery followed remarks from overseas central bankers aimed at calming market nerves. Alvin T. Tan, head of Asia FX strategy at RBC Capital Markets, noted that early Asian trading appeared calmer and that there was no immediate sign of a U.S. recession. Overnight, Federal Reserve San Francisco President Mary Daly emphasized the importance of preventing a downturn in the labor market and indicated openness to cutting interest rates if necessary, reinforcing expectations of a 50 basis point cut by the Fed in September.