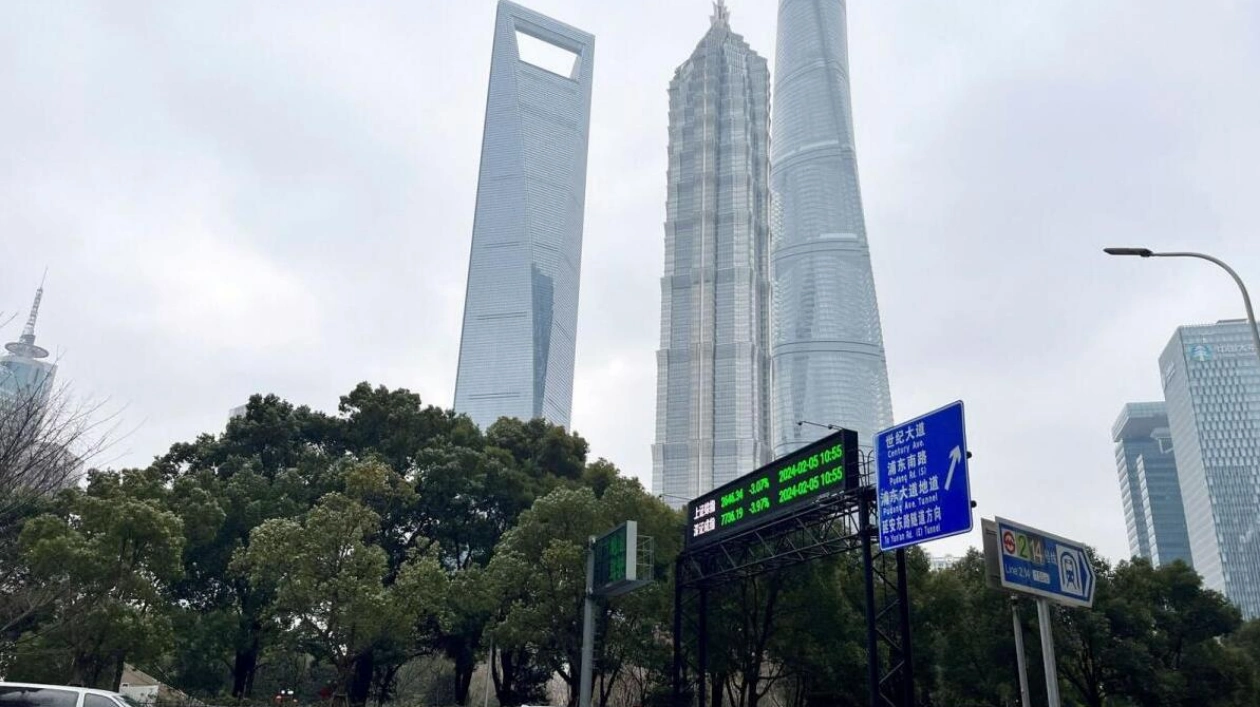

Chinese stocks experienced their most significant single-day gains in 16 years on Monday, with domestic A-shares recording their highest-ever turnover as investors rushed to join a rally ignited by Beijing's recent stimulus measures. The CSI300 blue-chip index has surged nearly 30% from its February low, meeting some market definitions of a bull market. However, much of these gains occurred rapidly over just a few sessions since last week.

Traders, anxious about missing out on the upswing before a week-long holiday starting Tuesday, pushed the CSI300 index up by 8.5% at the close, resulting in a five-day gain of over 25%—the strongest on record. The broader Shanghai Composite Index saw a total turnover of 1.17 trillion yuan ($166.84 billion) and surged 8.1%, marking its best five-day performance since 1996.

The Shenzhen index also soared 11% and recorded a turnover of 1.4 trillion yuan. This blistering rally in Chinese stocks follows the most aggressive stimulus measures announced by Beijing since the pandemic, including significant rate cuts and fiscal support aimed at stabilizing the struggling economy. The People's Bank of China (PBOC) introduced two new tools to bolster the capital market, including a swap program that makes it easier for funds, insurers, and brokers to access funding for stock purchases.

This move ignited beaten-down Chinese equities that had been trading near multi-year lows earlier this month due to concerns over China's growth prospects. "It's really a big turnaround; the policies are so intensive. We've never seen such clear instructions to halt declining housing prices and support the stock market," said Dickie Wong, executive director of research at Kingston Securities.

Foreign investors are eager to avoid missing out, local retail investors are seeking advice on what to add, and institutional investors are rushing to the market. These inflows have pushed the Hang Seng Index up to 21,000. Hong Kong's Hang Seng Index, which advanced 2.4% on Monday, is now up roughly 24% for the year, making it Asia's best-performing stock market.

Adding to the positive momentum, China's central bank announced on Sunday that it would instruct banks to lower mortgage rates for existing home loans before October 31, as part of broader policies to support the struggling property market. Guangzhou city also lifted all restrictions on home purchases, while Shanghai and Shenzhen eased buying curbs. This boosted property company shares, with mainland-listed property stocks advancing 8.2% and the Hang Seng Mainland Properties Index rising 6.4%.

Investor optimism that the latest measures could revive China's sluggish domestic consumption also lifted shares of consumer staples by 8.8%, their biggest daily gain in 16 years. For the month, the CSI300 index gained 21%, its best performance since December 2014. The Shanghai Composite Index similarly ended September with a 17% increase, its most since April 2015. The Hang Seng Index had its best month since November 2022 with a 17% rise, following its biggest weekly gain since 1998.

Mainland financial markets will be closed from October 1-7 for National Day holidays.