The commodities sector is poised for its fourth straight weekly gain, with August seeing support from a weaker dollar, lower Treasury yields, and expectations that the US Federal Reserve will initiate several rate cuts starting at the September 18 FOMC meeting. Market observers have shifted from anticipating a severe economic slowdown to expecting a soft landing, and with inflation easing and signs of recovery in China, the demand for growth- and demand-sensitive commodities has brightened. However, significant uncertainties persist. Ole Hansen, Saxo Bank's head of commodity strategy, noted in a recent report that while the month-long correction seems to have concluded, a robust rebound is unlikely until the global economic outlook notably improves, particularly in China and Europe where economic growth expectations continue to wane.

The Bloomberg Commodity Total Return Index rose about 1.3% for the month and 2.2% for the year, despite losses in the energy sector, primarily in fuel products and natural gas, and a reduced decline in grains. These losses were offset by gains in industrial and precious metals, and notably in soft commodities, where adverse weather conditions bolstered sugar, coffee, and cocoa prices. It's important to note that cocoa and EU natural gas, both of which saw significant increases, are not included in the BCOMTR index. Analysts foresee September as a month of volatility, especially due to market reactions to the FOMC's anticipated rate cut and its potential impact on the dollar, which rebounded last week from a seven-month low.

Interest rate-sensitive investors might welcome the start of a rate cut cycle, potentially boosting demand for industrial metals and gold, as lower carrying costs attract ETF investors. Historically, gold has struggled in September, averaging a 3.2% loss over the past seven years. However, given the multiple supportive factors in an uncertain global environment, a short-lived correction is suspected. Crude oil markets are closely watching Opec+ and their decision on an October production increase, complicated by Libya's political turmoil potentially disrupting oil supply. Crude oil prices have been trading within a tight range, supported at lower levels but capped at higher ones due to various factors including demand concerns and geopolitical risks.

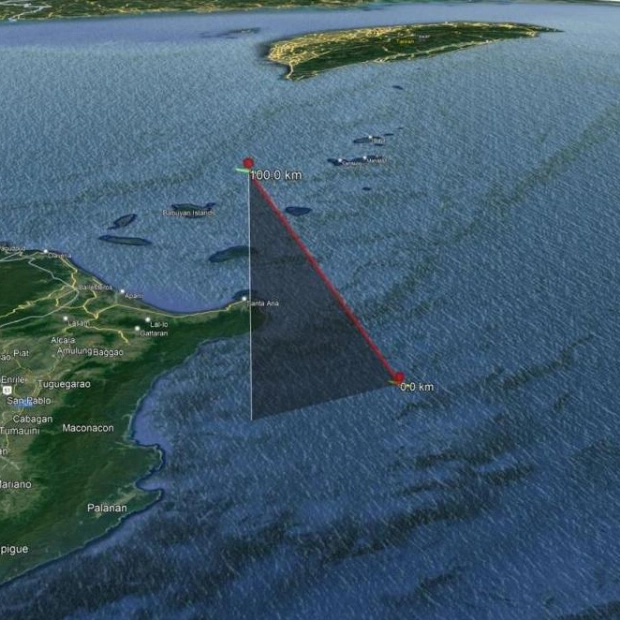

Since Opec+ announced a 2 million bpd production cut in October 2022, Brent prices have mostly remained stable, averaging slightly over $83. This strategy by OPEC+ has stabilized prices but also encouraged non-OPEC+ production, complicating efforts to increase output without negatively impacting prices. The loss of about 500,000 barrels a day from Libya and increased scrutiny on overproducing countries like Iraq, Kazakhstan, and Russia are expected to support a gradual increase in production from October, potentially adding 2.5 million barrels per day to the market by September 2025.

Gold prices dipped to a week's low of $2,501.20 per ounce after hitting a new record high at $2,532. Several factors are supporting gold's ongoing rally, with many investors using it as a hedge against global uncertainties. The grains sector will also be closely monitored in September as the results of this year's northern hemisphere harvest become clear. Despite the prospect of another bumper crop, the sector remains heavily shorted by large speculators, and any adverse weather developments could lead to significant price adjustments.