Emirates Development Bank has announced financing deals totaling Dh 362 million to support the growth of the UAE's manufacturing sector, with a focus on enabling mSMEs. The bank has provided more than Dh5.4 billion in financing to the country's manufacturing sector year-to-date in 2024, marking a significant increase in financing compared to previous years, following the launch of its new strategy in April 2021. These financing deals are in line with EDB’s commitment to facilitate Operation 300 billion and the advancement of local manufacturing capabilities. As part of the UAE Industrial Development Strategy, the bank has earmarked a portfolio of Dh30 billion to support priority industrial sectors by 2026, aiming to finance 13,500 businesses across manufacturing, advanced technology, food security, healthcare, and renewables.

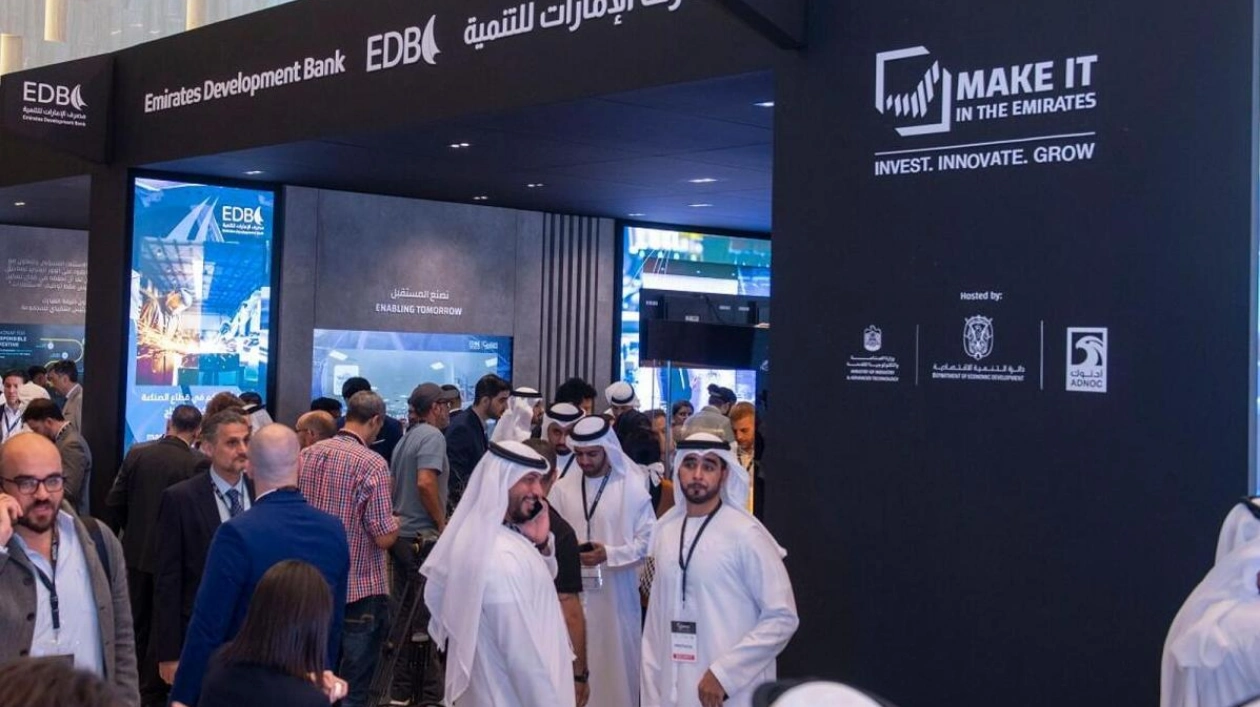

Ahmed Mohamed Al Naqbi, CEO of Emirates Development Bank, emphasized the impact of the financing announcements during the Make it in the Emirates Forum, stating that they will drive significant progress in advanced technology adoption, economic resilience, and industrial leadership. He highlighted the bank's increased support for the manufacturing sector, constituting 48% of its total financing over three years and playing a critical role in the UAE's economic diversification and sustainable development vision.

During the Make it in the Emirates Forum, EDB revealed financing deals, including capex loans and working capital, for 13 companies operating in various manufacturing industries within the bank’s five priority sectors. These companies encompass KEC EPC LLC, Trofina Food (ME) FZC LLC, Global Surfaces Group, Deep Sea Food Company, Neelkamal Plastics Manufacturing, Dolphin Manufacturing Ltd LLC, Scandinavian Papers Industries CO. L.L.C, SIBCA, Medeco Protective Safety Equipment Manufacturing, Abu Dhabi National Paper Mill, Super Cement, Aspen Polystyrene, and ACE Centro.

EDB's financing deals are geared towards fostering a robust private sector, bolstering advanced manufacturing, diversifying critical supply chains, promoting food security solutions, expanding climate finance and renewable energy, improving access to healthcare systems, and facilitating the deployment of advanced technologies. In alignment with the Bank's objectives, these initiatives aim to anchor jobs and investments in the UAE, enhance financing access for mSMEs, empower entrepreneurs, drive in-country value generation, and contribute to the national vision for a diversified, high-tech, and AI-driven economy. Emirates Development Bank is positioned as a crucial financial driver for the UAE's economic and industrial development, providing support to businesses of all sizes across strategic priority sectors. EDB was established by Federal Law by Decree No. 07 of 2011 issued by the late Sheikh Khalifa bin Zayed Al Nahyan, becoming operational in June 2015.