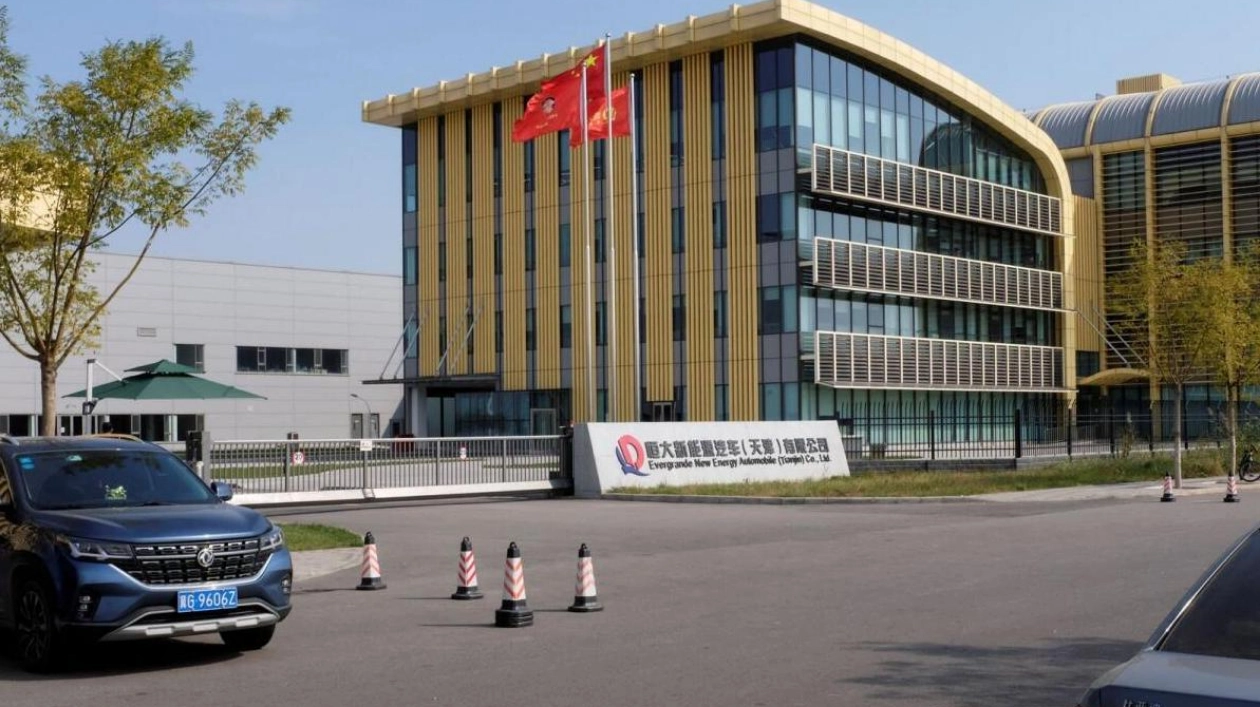

China Evergrande's electric vehicle group announced on Monday that a Chinese court has mandated the bankruptcy and reorganization of two of its subsidiaries, causing the EV group's shares to drop by 7.9 percent, marking their lowest point since May 16. This development concerning the New Energy Vehicle division of the struggling real estate developer follows creditor petitions filed last month, though the reasons were not specified. Such a bankruptcy and reorganization could affect negotiations between the liquidators of the parent company, China Evergrande Group, the most indebted property developer globally, and a prospective buyer looking to acquire a stake in the EV company, according to market observers.

A document on the National Enterprise Bankruptcy Information Disclosure Platform indicated that a creditor meeting regarding the reorganization will convene on October 22 at the Guangzhou Intermediate People's Court. The electric vehicle manufacturer disclosed that the court directed the subsidiaries, Evergrande New Energy Vehicle (Guangdong) and Evergrande Smart Automotive (Guangdong), to initiate the proceedings following a hearing on August 2. The company had previously alerted on July 28 that creditors of the two units sought court approval for bankruptcy and reorganization, noting that this would significantly affect its production and operational activities, leading to a further decline in the group's shares on July 29.

The Guangzhou Intermediate People's Court appointed Zhong Lun (Shenzhen) law firm as the administrator for the Evergrande Smart Automotive (Guangdong) reorganization. The creditors initiating the application were Guangdong Overseas Construction Consulting Co and Guangzhou Shenlong Road Transport Co. In May, the liquidators of the parent company, which held a 58.5 percent stake in the EV unit, revealed ongoing discussions with a third-party buyer to sell a 29 percent stake in the EV group, with an option to dispose of the remaining shares within a specified timeframe. No definitive agreement has been reached yet. The parent company indicated in late July that the initial terms included the buyer providing a credit line to the EV company to support its operations.