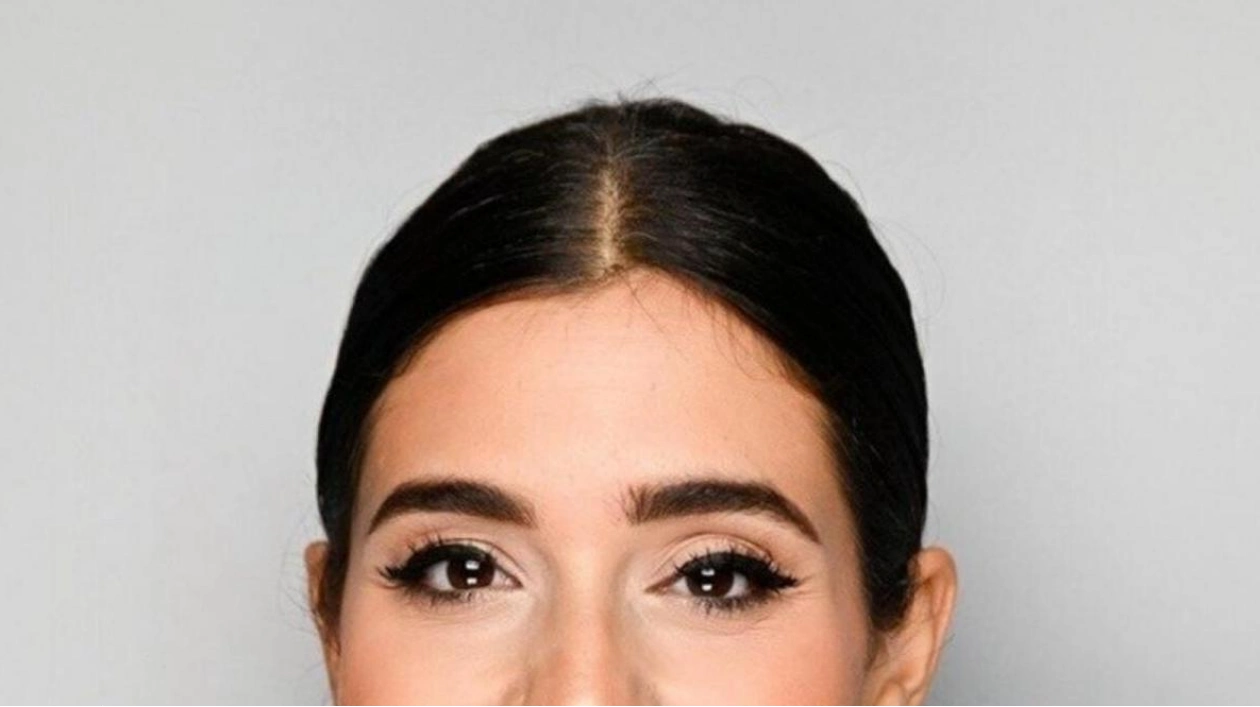

Randa Nasr, an Egyptian expatriate, serves as a parent relations executive at GEMS Al Khaleej International School in Dubai. At 34, she has been in the city for nine years. Having started working at 16, she understands that her relationship with money evolves continuously as she matures.

How do you define money? Money is the means. If you were to pen a letter to money, what would it say? Dear Money, where do I begin? I recognize your crucial role in providing for my basic needs—food, shelter, and clothing. I acknowledge that I haven’t always managed you well, but I’m now learning to cultivate a healthier relationship with you. I regret past treatment and promise to appreciate and spend wisely the money I earn. Thank you, Money, and I look forward to improving our relationship.

How would you characterize your relationship with money? It’s akin to love at first sight—a rapid, consequential kind of love. How did this relationship form? It began when I got my first job at 16. Deciding not to travel that summer, I opted to start earning. I vividly recall that spending my first salary was ten times more challenging than spending my parents’ money because I suddenly grasped the value of money and the effort required to earn it.

What financial management lessons did you learn from your mother? A key lesson is that we control ourselves. Money facilitates but never controls; it’s entirely up to us whether money brings happiness or misery. Who do you discuss money matters with? I usually talk about finances with my husband, who is wiser in financial matters.

Who has most influenced your financial management? My husband, who realized my financial shortcomings. It began when he introduced me to the concept of ‘priorities’. What’s the most profound money-related experience you’ve had? It was at 20 when my father decided I should manage my own finances and save. I was in university and debated whether to spend or be prudent. Proudly, I managed well, marking my first financial lesson.

How has living in the UAE altered your relationship with and perception of money/wealth? It has made me more confident, understanding the value of money, motivating me to excel. If you could advise your child or younger self about money, what would it be? Always work hard and value your spending.

What do you prioritize spending money on? My family and anything that fosters my growth. Do you have a long-term financial plan? Yes, I plan two to three months ahead, saving a small amount for unexpected situations. What’s your long-term financial goal? To build a grand mansion for my large family, setting priorities to achieve this dream.

How much do you save monthly? I ensure I save at least 25 percent of my income. How much do you aim to have by 65? I plan to retire then, aiming for a stable financial situation.