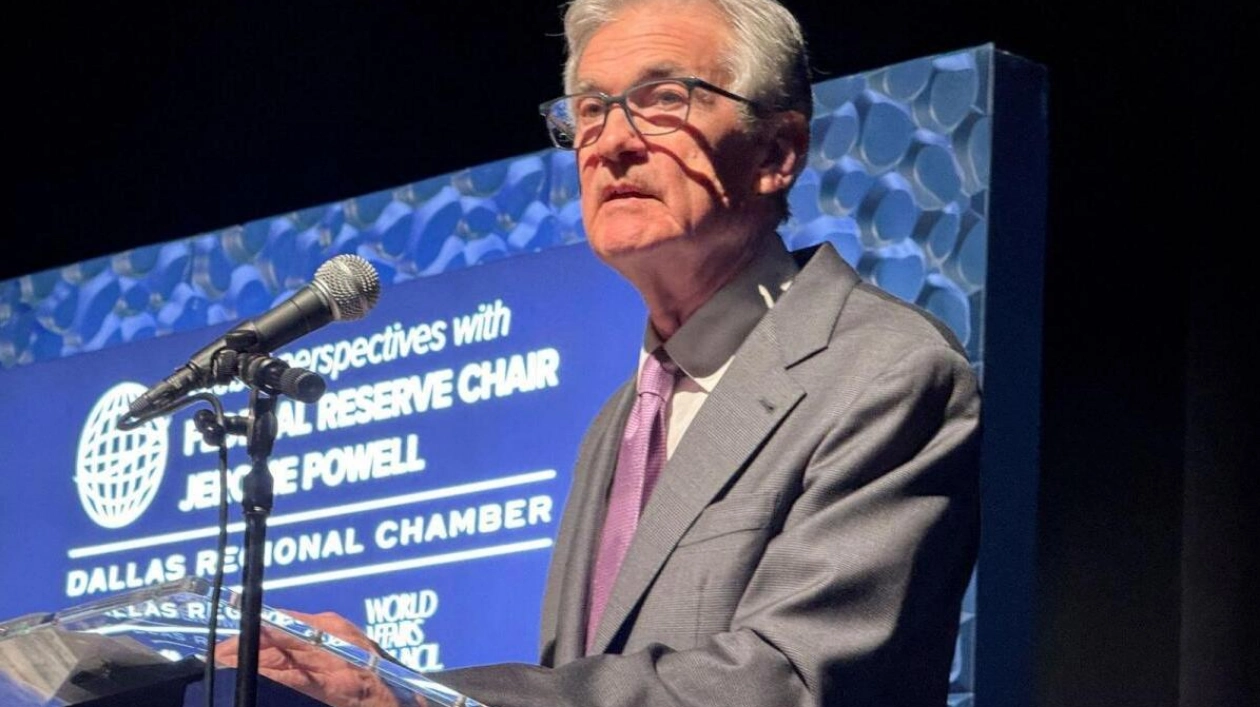

Federal Reserve Chair Jerome Powell's recent remarks in Dallas, Texas, reflect a significant shift in the central bank's role over the past 17 years. The Fed has played a pivotal role in US economic policy, deploying multi-trillion-dollar safety nets, providing nearly a decade of ultra-cheap money, and navigating unprecedented challenges during the Covid-19 pandemic. However, this expansive role has now evolved into more concise policy statements, debates over interest rates, and a reduced bond portfolio. There is also a growing perception that Powell may be remembered as both the leader who guided the US through the pandemic-induced economic crisis and the one who restored central banking to a more conventional, less dramatic state.

James Bullard, former President of the St. Louis Fed, observed the central bank's role expand during the 2007-2009 financial crisis and again during the pandemic. He notes that the Fed is now returning to a more traditional approach, focusing on inflation fighting without the need for unconventional measures. This shift is partly due to the economy's recovery and the normalization of interest rates.

Despite potential controversies, such as Donald Trump's possible attempts to undermine Powell, the Fed's focus on inflation control and economic growth suggests it may be moving to a less central role in policy-making. With inflation under control and interest rates stabilizing, the incoming administration may prioritize fiscal and trade policies over monetary measures.

Fed Governor Christopher Waller, a Trump appointee, is likely to play a key role in shaping the Fed's future policy framework. His focus on inflation and steering the Fed away from non-monetary issues like climate change indicates a return to a more traditional central banking approach. This shift is also evident in the Fed's recent policy decisions, which have been more focused on maintaining economic stability rather than addressing unconventional crises.

The Fed's current framework, adopted in 2020, aimed to address chronic inflation and low interest rates by committing to broad-based employment. However, the subsequent surge in inflation led the Fed to aggressively raise interest rates in 2022 and 2023. This move has potentially restored the economy's equilibrium, shifting the focus back to fiscal and trade policies.

As inflation pressures remain elevated, the Fed is now operating with rates sufficiently above zero, allowing for conventional monetary policy adjustments. While unconventional tools remain available, the current economic environment suggests a return to preemptive inflation suppression, a strategy that has regained favor among economists.

Powell's anticipation of these changes indicates a broader recognition that the US economy no longer requires extraordinary Fed support. His tenure may be marked by a transition from crisis management to a more traditional, focused central banking approach.

Source link: https://www.khaleejtimes.com