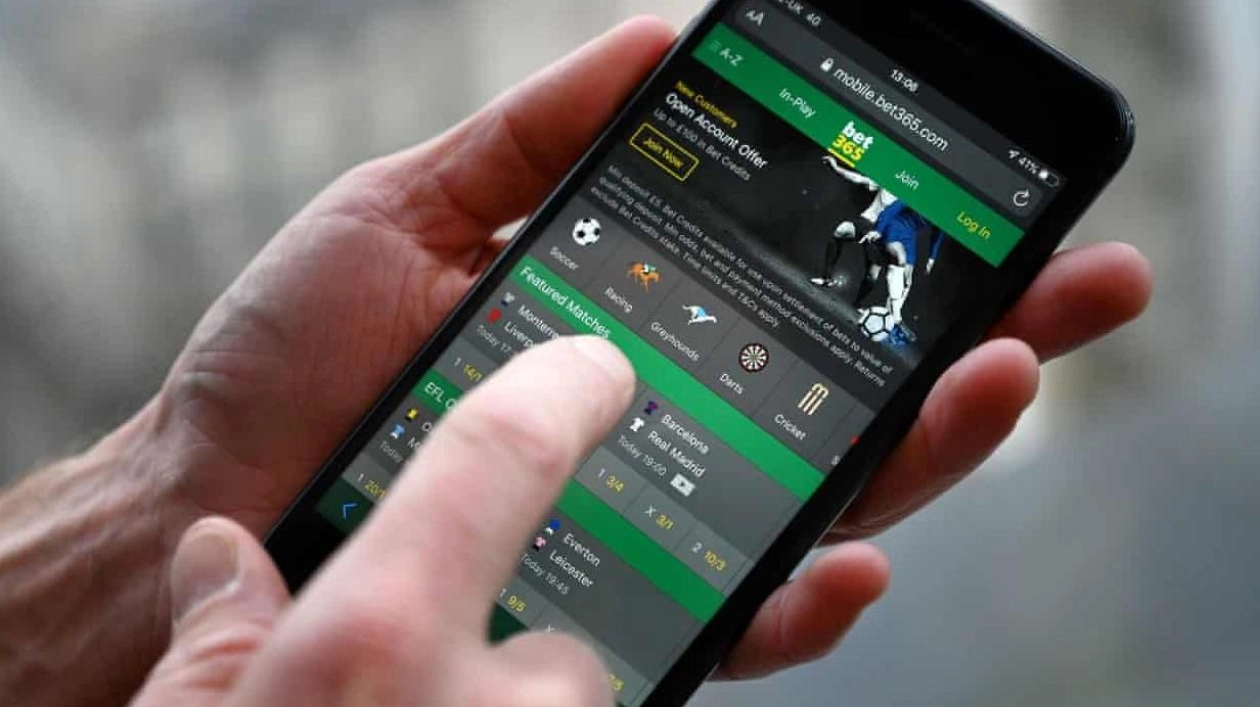

Nearly three months have passed since the general election campaign that brought Labour to power, accompanied by a flurry of unexpected betting-related headlines. The new government's plans for regulating the gambling industry, a matter with substantial implications for the racing industry, remain unclear. This situation may change on Tuesday, when Baroness Twycross, the minister for gambling, is set to speak at a fringe event at the Labour conference. Organized by the cross-party think-tank, the Social Market Foundation (SMF), the event is titled “Bad Money: the Economics of Gambling Harm.” While this might not initially seem promising for racing and betting, it could mark the beginning of a shift away from the gambling industry's 25-year focus on gaming products over traditional sports betting.

The extent to which Baroness Twycross will clarify the government's immediate plans remains uncertain. However, the event will be chaired by Dr. James Noyes, a senior fellow of the SMF with a long-standing interest in gambling issues. Noyes believes that an increase in the Remote Gaming Duty (RGD), the tax on gaming profits from products like online slot machines, is overdue. Living within the racing bubble can obscure the reality that online slots, widely considered one of the most harmful and addictive forms of online gambling, have seen an extraordinary rise in recent years. The number of active players on online slots has more than doubled in five years, from around 2 million to nearly 4.5 million, representing about one in ten adults. Between April 2022 and March 2023, the gross gambling yield (GGY) from online gaming products was £4 billion, with £3.2 billion, or 80%, coming from slots.

A couple of months ago, it was noted in this column that any move to increase the tax differential between betting and gaming products would benefit racing, as it would reduce the incentive for operators to use sports betting as a loss leader to attract new customers before steering them towards gaming products. Currently, duty on betting profits is 15%, while gaming products are taxed at 21%. Noyes and the SMF argue that many global gambling conglomerates pay much higher rates in overseas markets. In a report due to be published before the budget on October 30, they will propose that RGD should be at least 42%, doubling the current rate. This would be a positive development for betting and, by extension, for racing. While some may suggest that betting duty would soon follow suit, Noyes has clarified that the SMF's focus is solely on gaming. “Racing should be untied … from other sectors when it comes to the debate over regulation and taxation,” he stated on Twitter/X. “Online slots should be limited, but racing should be supported.”

The primary reason racing has been linked to the gaming sector in recent decades is that multinational gambling operators, having absorbed traditional bookmakers, have consistently blurred the lines between betting and gaming. Racing, for the most part, has passively observed this trend, particularly during the scandal involving £100-a-spin roulette machines in betting shops. The Betting and Gaming Council (BGC), the industry's main lobby group, is also keen to obscure these boundaries. However, the BGC's dual approach may be reaching its limit. Racing's fortunes are closely tied to betting, not gaming. If influential critics like the SMF are keen to separate the two, it is in the sport's long-term interest to stop spectating and actively support this separation.