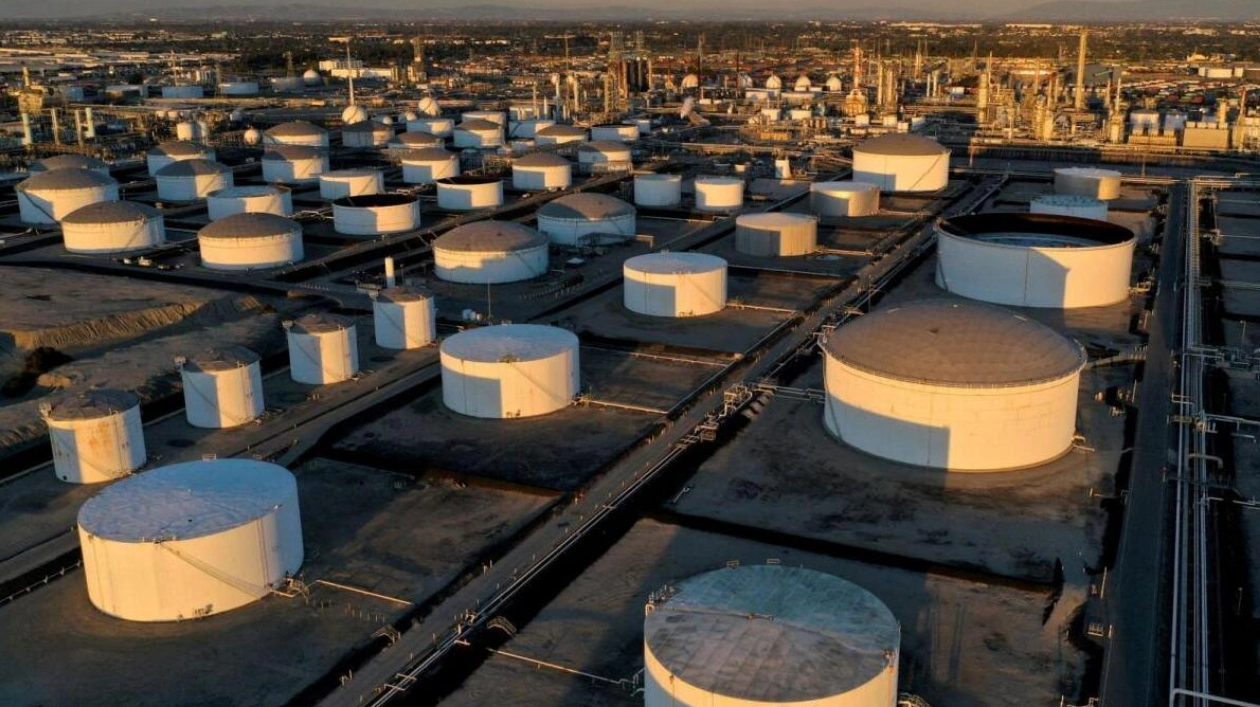

Oil refiners across Asia, Europe, and the United States are grappling with a significant decline in profitability, reaching multi-year lows. This downturn in the industry, which had previously enjoyed soaring returns post-pandemic, underscores the severity of the current global demand slowdown. The weakening profitability is a clear indicator of subdued consumer and industrial demand, particularly in China, due to slowing economic growth and the increasing adoption of electric vehicles. The addition of new refineries in Africa, the Middle East, and Asia has further exacerbated the downward pressure on margins.

Refiners like TotalEnergies and trading firms such as Glencore experienced record profits in 2022 and 2023, capitalizing on supply shortages caused by Russia's invasion of Ukraine, disruptions in Red Sea navigation by Houthi militants, and a robust recovery in demand following the COVID-19 pandemic. However, Commodity Context analyst Rory Johnston noted, "It's certainly looking like the refining supercycle that we've experienced over the past few years may now be coming to an end, with supply from newly inaugurated refineries finally catching up with slower-growing fuel demand."

Singapore's refining profits, a key indicator for Asia, plummeted to $1.63 per barrel on September 17, marking a seasonal low since 2020. Asia's diesel margins also hit a three-year low on the same day, according to LSEG data. The weak Chinese economy is a major factor, with industrial output growth in the world's top oil importer falling to a five-month low in August. Oil refinery output declined for the fifth consecutive month as weak fuel demand and soft export margins curtailed production.

In the United States, where demand has also fallen short of expectations, the 3-2-1 crack spread, a crucial measure of overall profitability, dipped below $15 per barrel in late August for the first time since early 2021. The 3-2-1 spread approximates the typical yield of two barrels of gasoline and one of diesel from every three barrels of oil processed by U.S. refiners. Gulf Coast gasoline margins, excluding renewable fuel blending obligations, averaged $4.65 per barrel as of September 13, down from $15.78 a year ago, while diesel margins were just over $11, compared to over $40 last year, according to Oil Price Information Service data.

Oversupply in the global diesel market due to weak demand is one of the primary reasons for the margin weakness. The International Energy Agency forecasts that diesel and gasoil demand this year will average 28.3 million barrels per day (bpd), contracting by 0.9% from 2023, while demand for gasoline, jet fuel, LPG, and fuel oil will grow over the same period. At the end of August, European diesel margins fell to about $13 per barrel, their lowest since December 2021, according to LSEG data. They averaged $16.6 per barrel in August, less than half of the $38.3 they averaged in August 2023.

The immediate outlook remains weak, although seasonal demand could provide some support. Energy Aspects analyst Raul Caldaria expects refining profits to remain low for the rest of the year, with potential upside from higher winter demand for diesel in Europe. Gasoline profit margins are also under pressure in Europe, despite stronger demand. They averaged $12.1 per barrel in August, a 61% decline from August 2023 levels of $31, according to LSEG data.

A spokesperson for Eni stated that the Italian refiner is "implementing measures to mitigate the reduction of refining margins" but declined to provide details on these measures. A spokesperson for Spanish refiner Cepsa said they are monitoring their profit margins but have not yet decided to slow down their processing. The startup of several new refineries has compounded the pressure on margins, particularly affecting older refineries in Europe.

Earlier this month, Petroineos confirmed it would close its Grangemouth refinery in Scotland, with shutdowns expected in Germany as well. This year, new capacity ramping up includes Nigeria's 650,000 bpd Dangote plant, Mexico's 340,000 bpd Dos Bocas, Kuwait's 615,000 bpd Al Zour, and Oman's 230,000 bpd Duqm. Vortexa's chief economist David Wech noted, "Globally there is clearly too much refining capacity currently relative to demand levels, with new capacity just making things worse."

Bank of America analysts on September 13 predicted that global refining margins will continue to slump, after falling 25% quarter-to-date and 50% on a spot basis, as new refining capacity increases by 1.5 million bpd year-on-year.