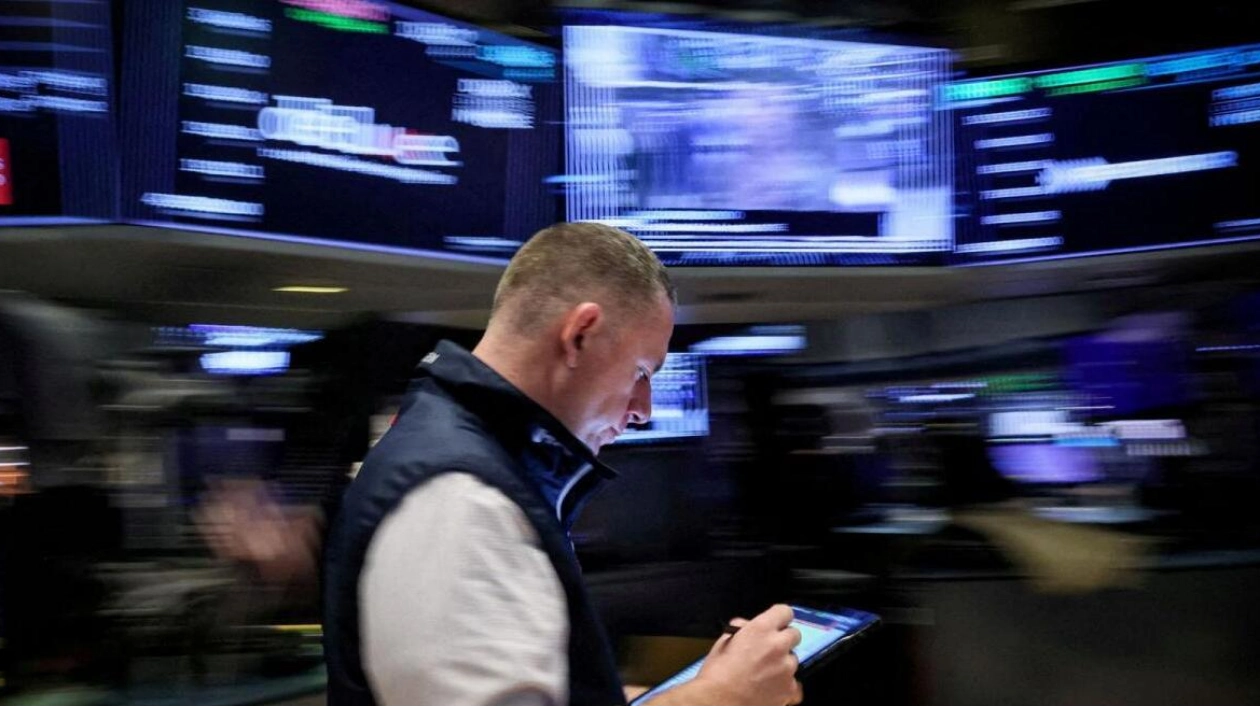

On Monday, global equities experienced significant declines as Wall Street joined a worldwide stock market downturn initiated in Japan. Concurrently, the dollar weakened against the yen, and US Treasury yields dropped due to concerns over a potential US recession. Oil prices also decreased during a volatile trading session, influenced by recession fears, but were partially supported by concerns over potential disruptions to crude supplies from escalating Middle East conflicts. The CBOE’s volatility index, often referred to as Wall Street’s fear gauge, moderated its gains, rising 12.5 points to 35.98 after earlier surging 42 points to 65.73, its highest level since March 2020 during the global COVID-19 pandemic. Japan’s Nikkei average closed down 12.40 percent, marking its largest single-day drop since October 1987. This sell-off was triggered by a weaker-than-expected US payrolls report for July, which led to a doubling of investor bets on a 50 basis points rate cut by the Federal Reserve in September. This followed disappointing earnings reports from major US technology companies. According to Eric Wallerstein, chief market strategist at Yardeni Research, the sell-off was due to a combination of factors including the unwinding of yen-funded trades, escalating Middle East tensions, disappointing US earnings, and the weak jobs report. However, US stocks recovered slightly after the Institute for Supply Management reported a rebound in services sector activity in July, with rising orders and employment, which eased recession fears. The non-manufacturing purchasing managers index rose to 51.4 from 48.8 in June, exceeding economist expectations. On Wall Street, the Dow Jones Industrial Average fell 1,090.72 points, or 2.74 percent, while the S&P 500 and Nasdaq Composite also saw significant losses. MSCI’s global stock index and Europe’s STOXX 600 index both experienced substantial declines. In US Treasuries, yields hit more than one-year lows, with the yield on benchmark 10-year notes falling to 3.773 percent. The Japanese yen strengthened against the dollar as traders unwound carry trades, anticipating a US recession and steeper Fed rate cuts. The dollar index fell 0.53 percent, while the euro rose 0.5 percent. In energy markets, US crude and Brent both saw slight declines. In precious metals, gold lost some of its safe haven appeal, with spot gold falling 1.98 percent.

Text: Lara Palmer

05.08.2024

Wall Street joins worldwide stock rout; dollar weakens and oil prices fall amid volatile trading