The gold price maintained its three-day upward trend, reaching a new high above $2,480 during Asian trading on Wednesday, with the market anticipating a move beyond $2,500. The expected interest-rate cut by the US Federal Reserve in September has led to this new peak for gold, which does not yield interest. Precious metal analysts suggest that the market is fully expecting the September rate cut, with a 60% chance of another cut in December.

Vijay Valecha, Chief Investment Officer at Century Financial, noted that the surge to an all-time high of $2,480 reflects investors' growing confidence in a September rate cut. He also pointed out that Jerome Powell's recent comments about the Fed's satisfaction with inflation's trajectory, along with geopolitical tensions and central bank purchases, continue to support gold. Additionally, the 10-year US Treasury yields fell to a four-month low on Tuesday, signaling closer rate cuts.

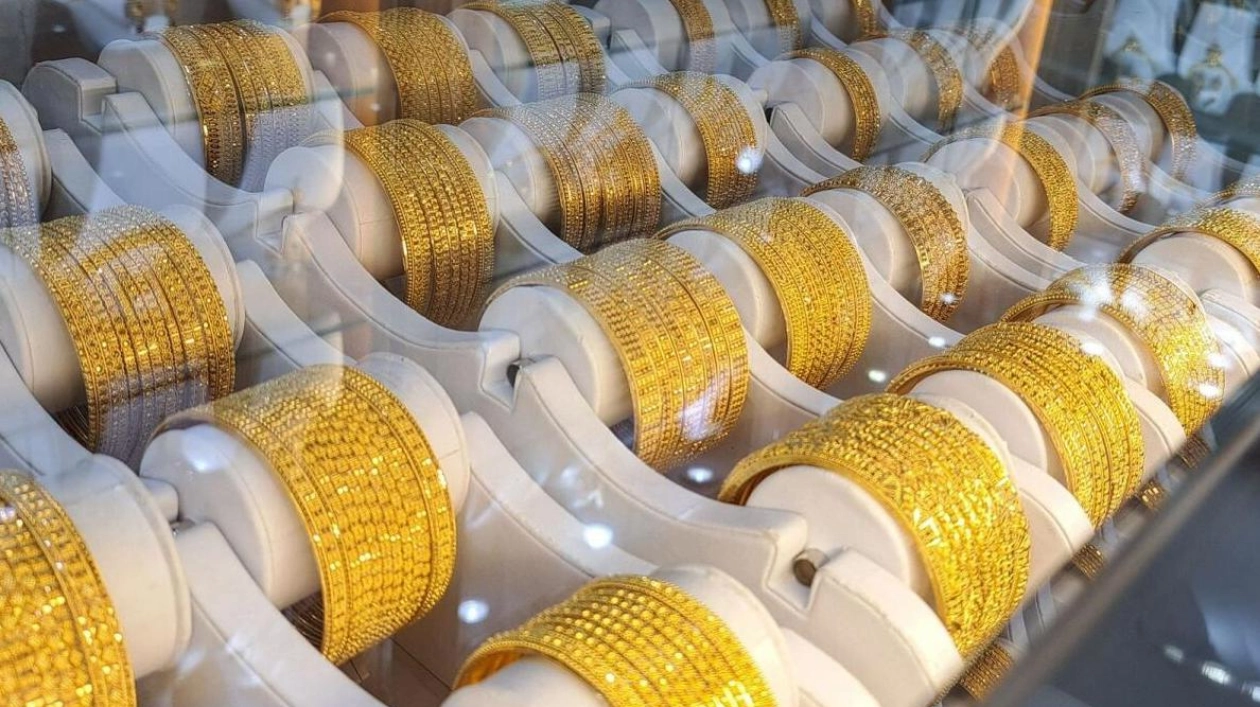

Valecha further mentioned that the Central Bank of the United Arab Emirates' gold reserves increased by 12% to Dh20.36 billion by the end of April 2024, with a monthly growth of 3.5% from March 2024. He analyzed that gold's Relative Strength Index (RSI) hit 77%, indicating strong price momentum, while the MACD remains robust at 4.14. Support levels are noted around $2,250 and $2,416, with resistance at the psychological level of $2,500 and above at $2,535.55.

The resumption of the dollar's downtrend, following a brief bounce, has aided gold in reaching new record highs above $2,450. Fed Governor Adriana Kugler's dovish comments have further fueled gold's bullish momentum. ANZ Banking Group analysts reported that despite a 10% rise in gold's price in 2023, consumer demand remained strong at 760 tonnes, only a 2% year-on-year decline, aligning with the long-term average.

Looking forward, the continued dovish sentiment around the Fed's interest rate outlook is expected to enhance gold's appeal. Any economic stimulus by China could also support gold prices. Technically, the sustained breakout above the $2,425-2,430 supply zone and subsequent move beyond $2,450 could trigger further bullish activity. However, significant resistance is likely near the $2,500 mark. Conversely, a substantial drop below $2,450 could present a buying opportunity, with potential support around $2,430-2,425. A decisive break below this level could lead to technical selling and push gold towards $2,400, with further declines possible towards $2,360.