Elevated interest rates are exerting pressure on the US retail sector, where numerous companies' shares have suffered due to months of stringent monetary policy, while a select few have experienced significant growth. The S&P 500 Consumer Discretionary Distribution & Retail index has risen by almost 14 percent this year, roughly matching the S&P 500's year-to-date increase. However, much of the sector's robustness is concentrated in a handful of stocks, including the prominent Amazon.com, which has surged nearly 21 percent this year. In contrast, shares of companies catering to lower-income consumers have faced challenges, partly because this demographic has been more impacted by rising interest rates, according to analysts. Among the most significant underperformers are Dollar Tree's shares, which have declined nearly 27 percent year-to-date, and Dollar General's, which have dropped nearly 9 percent. The retail sector is one of several areas of the economy, along with real estate and consumer staples, that have been affected by high rates. The Federal Reserve recently emphasized that it requires further evidence of declining inflation before reducing borrowing costs. "The lower to middle-income segment is being squeezed due to rising gas prices and groceries," explained Greg Halter, Director of Research at Carnegie Investment Counsel. "They feel the pinch despite the economy's overall health." Consumer sentiment will be in the spotlight next week when the US releases retail sales data on Tuesday. Analysts anticipate a 0.2 percent growth in retail sales for May. Results weaker than expected, following last week's data indicating promising progress on inflation, could strengthen the argument for the Fed to reduce rates earlier. Futures markets have shown increased investor expectations for a September rate cut, although the Fed anticipates lowering borrowing costs only in December. The varied performance of retail stocks has led investors to concentrate on companies whose consumers can endure higher interest rates or those offering discounts on branded household items like clothing or groceries, such as warehouse club company Costco Wholesale. Halter's fund has been acquiring shares of companies like Walmart, Costco, and TJX Companies, whose business models prioritize value for the consumer. Their shares have risen 28 percent, 29 percent, and 16 percent respectively. Robert Pavlik, Senior Portfolio Manager at Dakota Wealth Management, noted that he holds Costco and TJX Companies due to their robust management and inventory controls. "I believe inflation will persist but moderate, and consumers will continue to seek value for their money," he stated. Bokeh Capital Partners holds shares of Urban Outfitters, which have increased over 20 percent this year. Kim Forrest, Bokeh's Chief Investment Officer, attributed Urban Outfitters' resilience in the inflationary environment to its strength as a fashion merchandiser, adding, "People will make sacrifices to maintain their appearance." Josh Cummings, a Portfolio Manager at Janus Henderson Investors, anticipates that sectors like online shopping will continue to flourish even if interest rates remain high. He has been focusing on companies such as Carvana, whose shares have almost doubled this year, and DoorDash, whose shares have risen around 13 percent. "We're not overly enthusiastic about the consumer sector overall, but we believe we are in the early stages of some of these growth narratives," he commented.

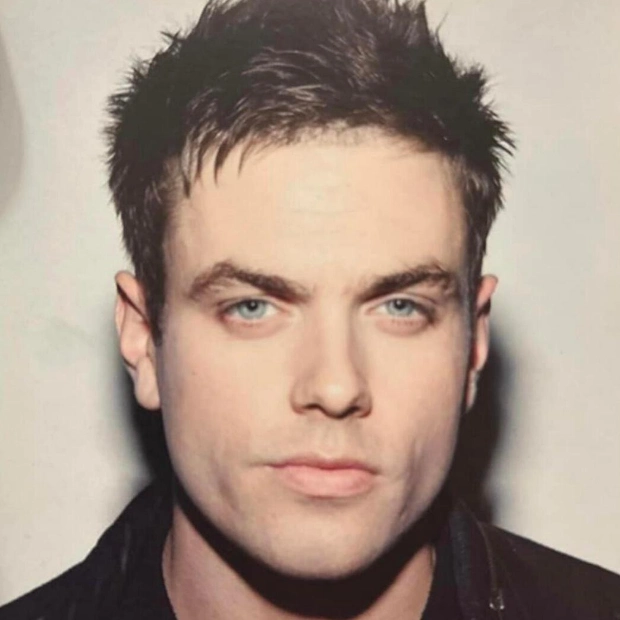

Text: Lara Palmer

16.06.2024

Select Retail Stocks Soar Despite Sector Pressures; Consumer Focus Shifts to Value and Discounts