A recent report by ACI Worldwide and Global Data reveals a significant surge in real-time payment transactions in the Middle East. The region is projected to experience a remarkable increase, with transactions expected to escalate from $675 million in 2022 to $2.6 billion by 2027, indicating a compound aggregate growth rate (CAGR) of 30.6% as per ACI’s 2023 Prime Time for Real-Time report.

This substantial surge in digital adoption driving higher transactions is primarily attributed to the burgeoning younger population in the region, embracing new technologies to streamline operations. While the digital transformation of financial services is a global trend, certain Middle Eastern countries are leading this shift in both adoption and transaction volumes.

The Middle East has witnessed a surge in the uptake of fintech services, mobile banking, and digital payment methods, propelled by the technologically proficient population. This trend presents significant opportunities for the expansion of financial services platforms, facilitating the provision of user-centric interfaces for banking, investments, and financial planning, thereby enhancing the overall financial experience.

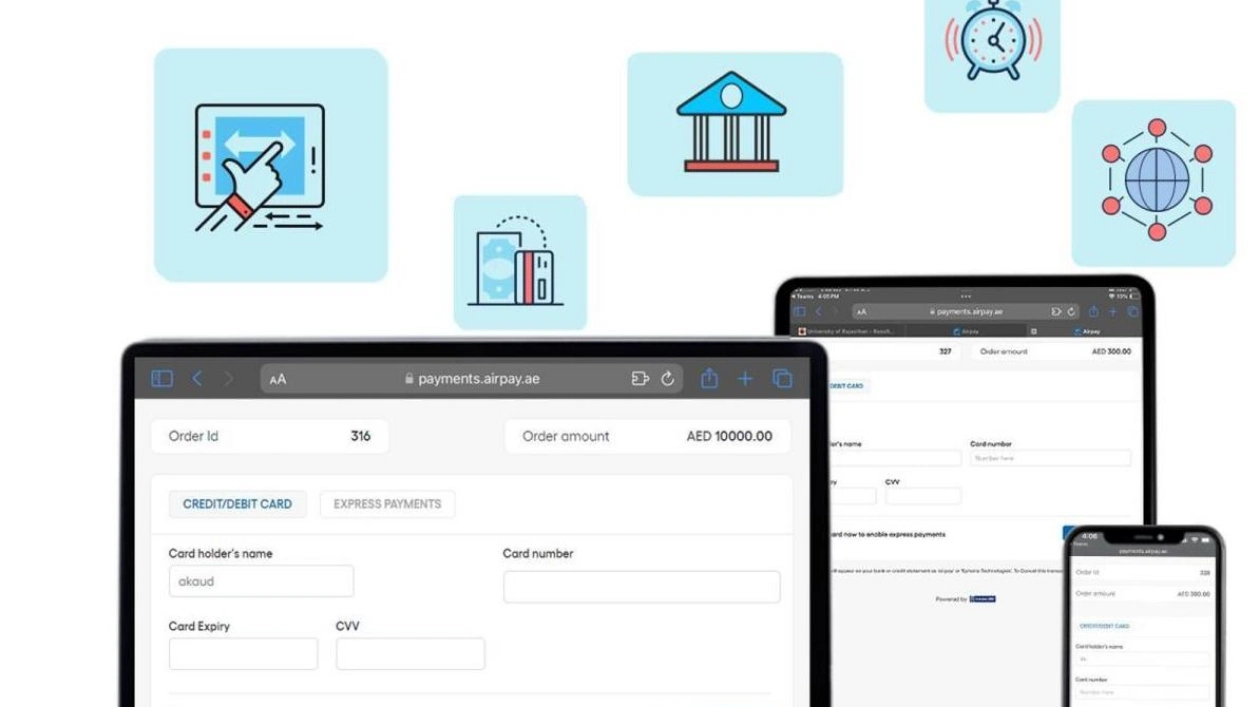

Airpay is strategically positioned to offer local banks and conglomerates an advanced payment technology platform tailored to cater to diverse acquiring and issuing solutions in this dynamic market. The company's comprehensive platform, equipped with scalable APIs, reconciliation and settlement solutions, and rapid go-to-market capabilities, enables it to address the evolving market demands, according to Kunal Jhunjhunwala, Founder and Managing Director of airpay.

The surge in real-time payments adoption in the Middle East has been bolstered by visionary governments and central bank support. Real-time payments are poised to play a pivotal role in fostering financial inclusion and driving economic growth in the region. Innovative initiatives are flourishing in the Middle East, with a strong emphasis on widespread digital transformation to create an enabling environment for the digital economy.

The UAE stands out as a thriving nexus of economic activity, renowned for its visionary leadership, strategic location, and progressive policies. Its strategic positioning has cemented its status as a global financial hub, drawing investors, entrepreneurs, and professionals from across the globe. The robust regulatory framework and infrastructure have been instrumental in bolstering economic growth, positioning the UAE as a premier destination for financial service providers.

According to Kunal Jhunjhunwala, “The Middle East presents a dynamic and rapidly evolving market that perfectly aligns with airpay's goal of revolutionizing digital payments. Our decision to introduce cutting-edge payment solutions in the UAE is driven by the region's strong appetite for innovative financial technologies and the growing base of tech-savvy consumers. Our aim is to empower businesses and individuals in the UAE with seamless, secure, and efficient payment methods that enhance convenience and contribute to the ongoing financial modernization in the region.”