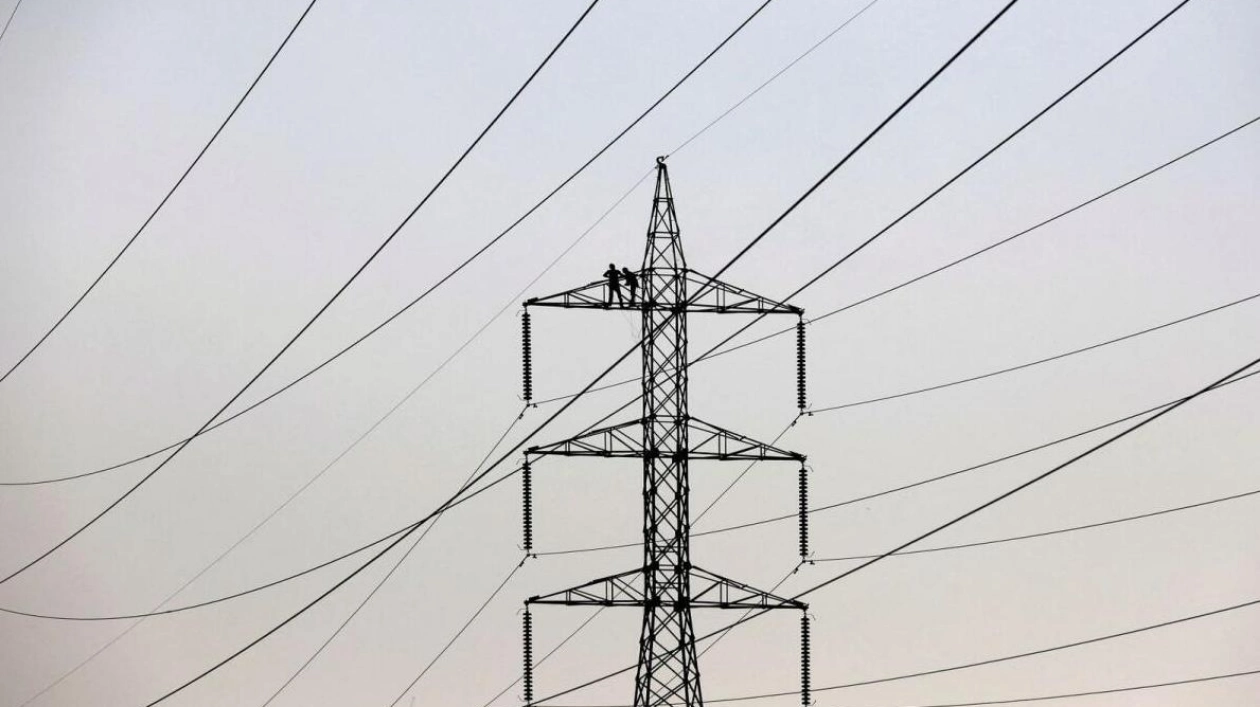

Pakistan plans to request Chinese power plants operating within its borders to switch from using imported coal to coal from the Thar region, according to the power minister, who spoke on Sunday. During a visit to Beijing, discussions may also commence regarding the restructuring of Pakistan's energy sector debt, revealed Awais Leghari, the head of the Power Division at the energy ministry. Leghari is set to join a delegation to negotiate structural reforms in the power sector, as recommended by the International Monetary Fund (IMF), which recently approved a $7 billion bailout for the debt-ridden South Asian country. China has invested over $20 billion in energy projects in Pakistan.

Leghari emphasized in an interview that one of the main objectives of the trip is to convert coal-fired units from imported to local coal, which would significantly reduce the cost of power. This conversion would alleviate pressure on Pakistan's foreign exchange reserves, making it simpler for Chinese-owned plants to repatriate dividends and achieve a better return in dollar terms. This transition is projected to save Pakistan over 200 billion Pakistani rupees ($700 million) annually in import costs, leading to a potential reduction of up to 2.5 Pakistani rupees per unit in electricity prices.

In April, a subsidiary of Engro Corporation agreed to sell all its thermal assets, including the leading coal producer Sindh Engro Coal Mining, to Liberty Power. Liberty cited Pakistan's foreign exchange crisis and the potential of its indigenous coal reserves as reasons for the acquisition. The minister did not provide further details on potential talks with China about restructuring energy debt. Pakistan's power sector suffers from high rates of power theft and distribution losses, leading to accumulating debt throughout the production chain, a concern highlighted by the IMF.

The government is implementing structural reforms to reduce 'circular debt'—public liabilities that accumulate in the power sector due to subsidies and unpaid bills—by 100 billion Pakistani rupees ($360 million) annually. The previous IMF bailout, which concluded in April, included raising power tariffs, negatively impacting poor and middle-class households. Annual power consumption in Pakistan is expected to decline for the first time in 16 years due to higher tariffs, despite summer temperatures approaching record levels, which usually increase the use of air conditioning and fans.

Leghari noted a shrinking demand trend over the past year and a half and anticipates this to continue unless power prices are rationalized. The government's primary challenge is to halt the decline in demand. With the per-unit tariff for power being more expensive, both urban and rural households are increasingly turning to alternatives like solar energy. Leghari estimates that solar power could be five to six times more prevalent on the grid than the current conservative estimate of close to 1,000 megawatts.