The Philippines is set to impose a 12% value-added tax (VAT) on digital services provided by major tech companies like Amazon, Netflix, Disney, and Alphabet. This move aims to create a level playing field with domestic brick-and-mortar businesses, according to the internal revenue agency.

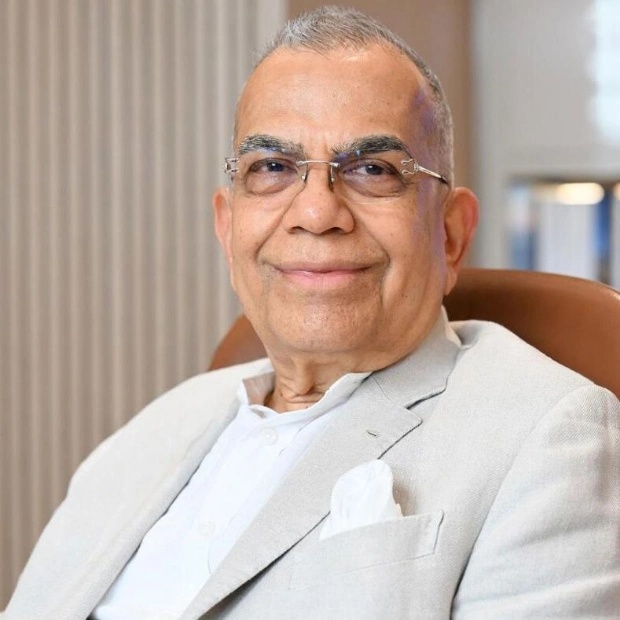

President Ferdinand Marcos Jr. signed the law on Wednesday, which applies VAT to non-resident digital service providers such as streaming services and online search engines. "This will promote fair competition among businesses benefiting from consumers in the Philippines. A level playing field leads to better products and services," said Bureau of Internal Revenue Commissioner Romeo Lumagui in a statement.

Currently, only domestic digital service providers are required to pay the 12% VAT. Netflix has not issued a statement at this time, according to an Asia-Pacific spokesperson. Disney, Google, and Amazon did not respond to requests for comment.

The government expects to collect 105 billion pesos ($1.9 billion) from the VAT between 2025 and 2029. It plans to allocate 5% of this revenue to support projects for Philippine creative industries, according to the presidential communications office. Educational and public interest services will be exempt from the VAT.

Digital services provided by foreign firms are considered rendered in the Philippines if they are consumed within the country, the revenue agency clarified. Since the pandemic, tech giants have seen increased usage in Southeast Asia but also face stricter fiscal tax regulations.