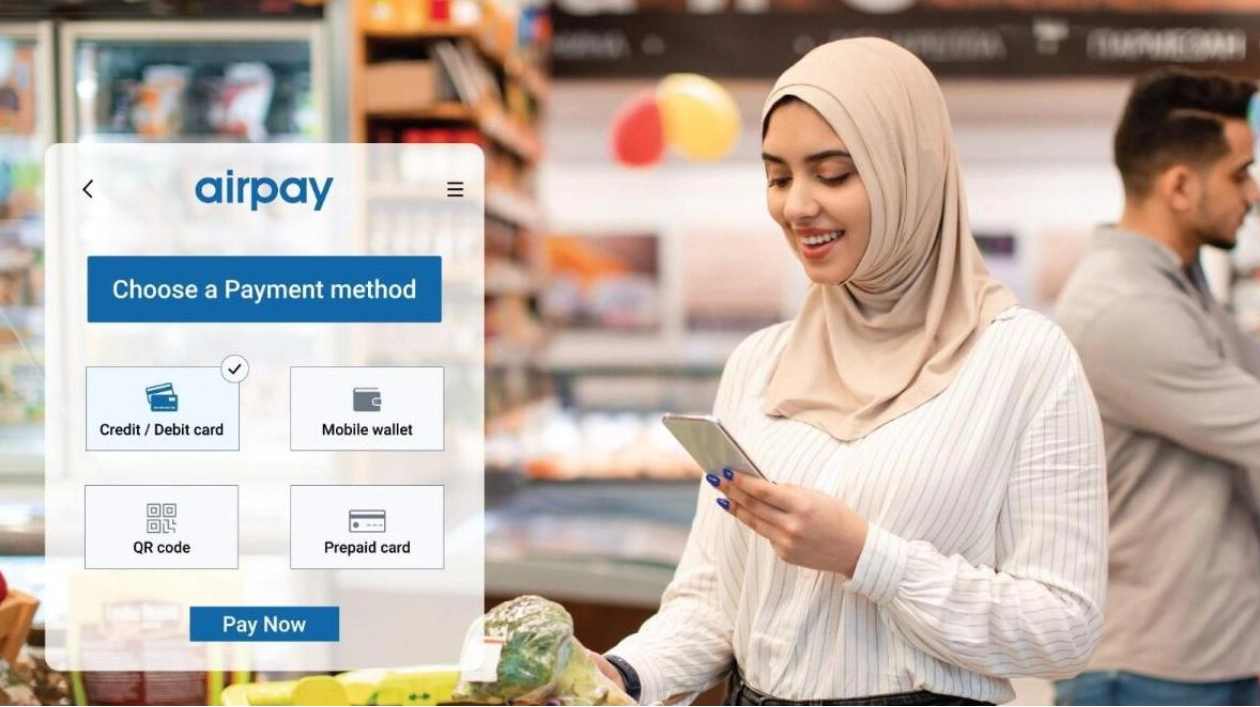

The era of mass-produced products and solutions under the 'One Size Fits All' philosophy is fading. Today, customer segmentation is highly detailed, and demands are specific and unique, necessitating tailored offerings. In developing countries, a growing youth population is embracing new technologies for enhanced convenience. The World Payments Report 2023 by Capgemini predicts non-cash transactions will nearly double by 2027, driven by instant payment infrastructure and open banking. Despite the convenience of cash, its global use is declining. Regulatory measures and central bank policies worldwide are fostering digital ecosystems, ensuring secure and robust payment systems. In India, post-demonetisation and COVID-19, digital payments surged, supported by the NPCI and UPI. UPI has seen significant growth, overtaking credit and debit cards. India is promoting UPI globally, with talks underway with 30 countries. Africa is also rapidly adopting digital payments, driven by telecom companies, enhancing financial inclusion. The Middle East and North Africa region, a global financial hub, is enhancing its digital payment infrastructure, aiming for a 14% growth in non-cash transactions. Governments in the region are investing in digital payment ecosystems, moving towards a less cash-dependent economy.

Text: Lara Palmer

27.06.2024

Growing Demand for Tailored Offerings and the Rise of Digital Payment Systems Globally