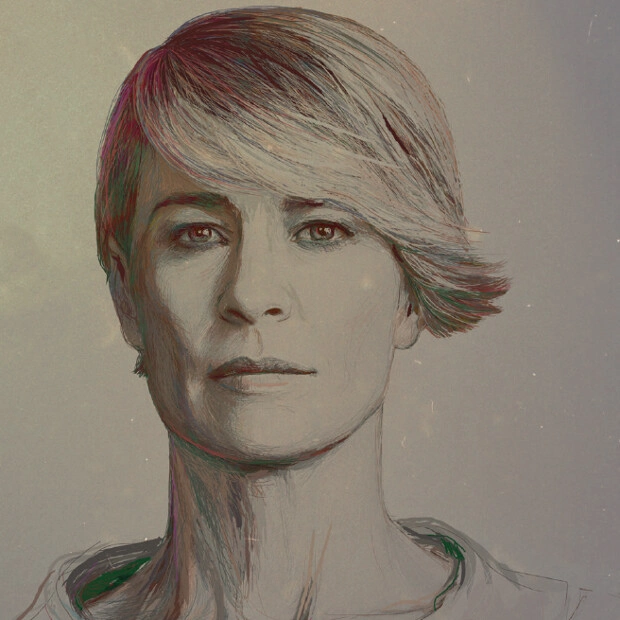

The world undergoing global changes, black swans beyond count, many women, catching at the wrong end of gender socialisation, are still making a major mistake when it comes to money matters. ‘My mission is improving the world community’s financial awareness. So, I’ve launched a company, teaching the ABC of finance’, says finance & crypto advisor Yelena Kozar.

When a child, I was really fond of ‘The Godfather’, its idea of family-like clanship, based on mutual help and support fascinating me. In this respect, my family in some ways resembled Scorsese’s romantic characters. It was so wonderful to feel safe, protected, and supported. All too soon, I grew up, went to university, and got married, my destiny still unclear to me. I cannot tell you all my friends’ and clients’ stories. The only thing I can share is a general conclusion I’ve arrived at after many years: women not inter- ested in financial matters, preferring to lay all responsibility for earning and handling money on men, often find themselves very vulnerable in times of uncertainty or global changes.

The reason is obvious - many girls are still brought up in the patriarchal tradition of marrying well. En route to adulthood, they observe boys having nights out and themselves kept at home, waiting for their Mr. Right to come their way and make them happy. There’s definitely nothing wrong with wish- ing to become a good housewife, but why are the matters of finances usually a taboo? Somehow or other, many families find themselves unable to come to terms in this area of life. Moreover, even raising and discussing the issue is generally viewed to be men’s sole right, even though it concerns each family member in equal measure.

A financially illiterate woman cannot keep what her man has earned from being wasted. In times of trouble like ours – a life of luxury over with a rough reality here to stay – it’s of vital importance for women to be able to make head or tail of how the financial world works lest thieves and go-betweens in the disguise of experts should deprive them of their assets in the blink of an eye. A good example of what can happen is to be found in ‘Blue Jasmine’, a brilliant Woody Allen film, featuring Oscar-winner Cate Blanchett in the role of a lionne, losing all her money and social status after her husband’s defrauding his clients.

Over the past century, gender inequality has been, by and large, done away with. Nowadays, women do business and work in top corporate positions quite successfully, developing their expertise and talents, on a par with men. ‘Dumb blondes’ have gone all the way from grotesque funny-story charac- ters, drawing money out of a safe and believing light to live in the fridge, to nuclear physicists.

The problem is that while making good money, some ladies fail to handle their finances wisely, either falling victim to scammers or entrusting their boy-friends with their assets only to find those guys using them in their own selfish interests.

So, many women run either to the extreme of a business lady, good at earning money and bad at managing her assets, or to that of a girl, brought up to marry well, not knowing what to do after that. Meanwhile, in the financial world, gender prejudices and emotions have zero value.

My aim is to educate both extremes. In the meantime, in no way do I advocate excessive women’s emancipa- tion! Yes, it is primarily the man’s job ‘to go hunting and bring a mammoth’ home. In other words, men should be prepared to take risks and suffer losses. While, it is the woman’s responsibility to distribute whatever bread the man wins wisely for the whole ‘tribe’ to last until his next successful ‘hunt’.

Whoever ‘puts the beans on the table’, managing family assets is the woman’s job so that she could feel confident of her own and her children’s well-being now and in the future, whatever the circumstances. Building a safe family environment is women’s natural calling and key to success. The fu- ture must be foreseen, among other things, for our children to know what university to go to. The steerer within this world picture is sure the family vessel is equipped with reliable lifebuoys and lifeboats. That’s the way to make the family business profitable for both partners.

If you are to found a close-knit family, you must understand that domestic harmony rests on three kinds of capital. The first is finances, be it an income, salaries, rent money, or dividends. The second is a combined intellect, each member allowing the rest of the family community to use his or her knowledge to strengthen everybody’s wellbeing. The third is human relationships, emotions, and traditions, i.e., everything, related to mutual consideration and acceptance. That’s what family ties are all about.

Children should be educated about finances from an early age. Parents’ job is to provide them with a firm foundation rather than conduct such cruel or offending experiments as in a real case of a holiday-making couple, flying business class to Thailand, with their children flying economy on board the same aircraft. This kind of attitude is highly likely to just hurt young people’s feelings badly, discouraging them from learning to make money. Everything related to everything else, the financial capital’s purpose is to support the family clan so that grown-up children could support their aged parents later.

Ever since I was a child, I’ve always wanted to build a world of my own with no nine-to-five-six-day-week limitations of freedom and prompt flights wherever and whenever I would wish. So, I eventually started studying the on-line sphere, embryonic at the time. One day, it occurred to me to Google-search for the richest people in the world, and I found out it was men of business and investors. That’s how I finally opted for finances and investments, offering an infinity of opportunities, indeed, as earning by investing can be a truly never-ending story.

Here’s a secret ingredient of financial literacy. It’s common knowledge money must make money, only 12.5% of married couples actually knowing how. Suppose, you need $3,000 a month for your basic expenses, which totals to $36,000 a year. To get this amount of passive income, an average APY at 15%, you need $240,000. What’s to be done if you don’t have the sum? You can start with ‘baby steps’ by investing $2,000 a month to hit the target of $3,000 a month in five years’ time, with a $240,000 basic capital in store.

Sounds easy enough. All you have to do is make the first and most difficult step towards building your passive income. Just hit the road and keep your project on track to make your dream come true. The sky of stars with its infinite space is the only limit! And White Space is always at your service!