Should Donald Trump return to the White House, the Federal Reserve's efforts to tame inflation could encounter new obstacles, potentially placing the U.S. central bank once again in the former Republican president's sights. A group of economists foresee Trump's tariff policies, plans to expel millions of undocumented workers, and the prospect of increased deficits, reigniting inflationary pressures that are currently subsiding, prompting the Fed to adopt a more stringent monetary policy than currently anticipated.

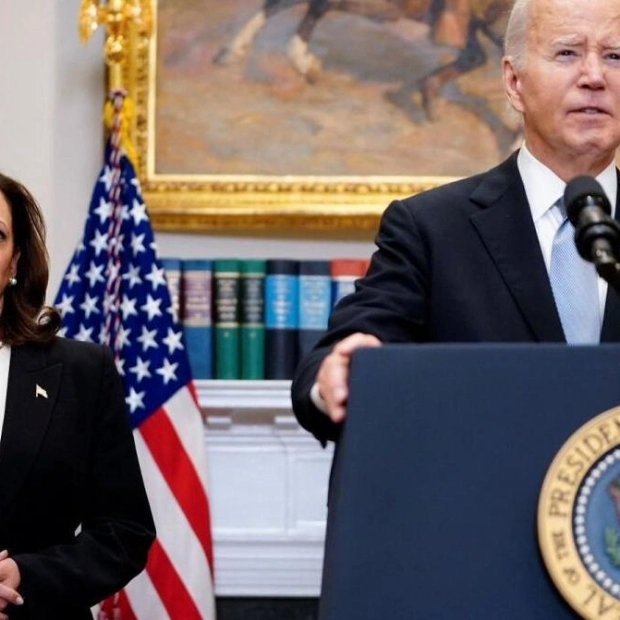

Economists predict that Trump's proposal to levy a 10% tariff on all imported goods, with even steeper rates on Chinese imports, would cause a temporary spike in inflation. Simultaneously, the deportation of undocumented workers would likely increase wages for those remaining, further intensifying inflationary pressures. An Oxford Economics model, which analyzes potential policy directions of the candidates, suggests that under a second Trump administration, a key inflation metric excluding food and energy prices, closely monitored by the Fed, could reach between 0.3 and 0.6 percentage points higher than expected under current legislation and policies. This contrasts with a potential inflation increase of only 0.1 to 0.2 percentage points under a Democratic administration led by Vice President Kamala Harris, who is expected to largely continue Biden's economic strategies.

The resurgence of inflation would pose a challenge to the Fed, which, after significant rate hikes, is close to mitigating historically high inflation levels, now declining towards the central bank's 2% target. Financial markets currently anticipate a rate cut in September, with further reductions likely to follow. Mark Sobel, U.S. chairman at the Official Monetary and Financial Institutions Forum, noted that Trump's economic program is inherently inflationary, citing higher tariffs, expansionary fiscal policies, and mass deportations as factors that would collectively elevate inflation and interest rates beyond what would otherwise be expected.

Diane Swonk, chief economist at KPMG U.S., highlighted in a recent note that Trump's tariff hikes and a significant reduction in foreign workers would likely lead to a resurgence in inflation, forcing the Fed to maintain current interest rates for an extended period. Oscar Munoz, chief U.S. macro strategist at TD Securities, pointed out that Biden and Harris's trade approach is markedly different from Trump's proposed tariff policies, suggesting that their more targeted trade measures would not pose a significant risk to inflation and growth forecasts.

Evercore ISI analysts believe the Fed might react more cautiously than markets to a Trump victory, potentially altering its rate cut plans for the coming year, possibly even scheduling a rate hike by late 2025. Karoline Leavitt, National Press Secretary for the Trump campaign, argued that the American public does not require economists' forecasts to determine which president has been more beneficial to their financial well-being. She assured that a return of President Trump to the White House would see the reimplementation of his pro-growth, pro-energy, and pro-jobs agenda, aimed at reducing living costs and uplifting all Americans.

Eric Rosengren, former leader of the Boston Fed, suggested on social media that the Fed should consider the implications of a Trump victory in its policy decisions, particularly regarding near-term rate cuts. However, Richmond Fed President Thomas Barkin expressed skepticism about making policy decisions based on anticipated future government actions. Meanwhile, Fed Chair Jerome Powell declined to comment on potential impacts of future policy changes, such as expanded tariffs, before Congress.

Jason Furman, former chair of the Council of Economic Advisers under the Obama administration and now an economics professor at Harvard, noted that any shift in inflation under Trump would be gradual rather than abrupt. He emphasized that while inflation might not reach 5 or 6%, it would nonetheless be higher than under other scenarios, necessitating tighter monetary policies.

The potential response of a victorious Trump to a Fed that either curtails or reverses rate cuts remains uncertain. During his previous term, Trump notably disagreed with Fed Chair Powell, whom he appointed. However, recent statements suggest he would not seek to remove Powell before his term ends in 2026. Barry Eichengreen, professor of economics and political science at the University of California, Berkeley, speculated that Trump might seek to reshape the Fed to align with his policy preferences, possibly nominating a more compliant Fed chair by May 2026. Scott Lincicome, a trade policy expert at the Cato Institute, warned that any attempts to undermine the Fed's independence could lead to significant market reactions, potentially deterring such actions by elected officials.