The Arab Monetary Fund (AMF) has disclosed that banks in the UAE hold the largest share of the Arab banking sector's assets, accounting for 24.3 per cent. According to the AMF's Financial Stability Report for Arab countries, the UAE banking sector's assets grew by 11 per cent, driven by a surge in credit and investments. Meanwhile, the Saudi banking sector's asset growth reached 9.3 per cent, fueled by a 11.5 per cent rise in real estate loans and credit growth in other economic sectors.

By the end of 2023, the total assets of the banking sector in Arab countries saw a significant increase, rising to $4.574 trillion from $4.355 trillion in 2022, marking a 5.0 per cent growth. Saudi banks closely followed the UAE, accounting for 23.1 per cent of the Arab banking sector's assets. Additionally, the GCC banking sector is projected to represent 73.1 per cent of the total assets by the end of 2023.

The report highlights that the growth in the assets of the Arab banking sector reflects customer and market confidence in the sector, despite regional and global instability. The growth in assets is attributed to the increase in banking sector assets in the UAE, Saudi Arabia, and Qatar, which collectively account for 58.9 per cent of total assets in the Arab banking sector.

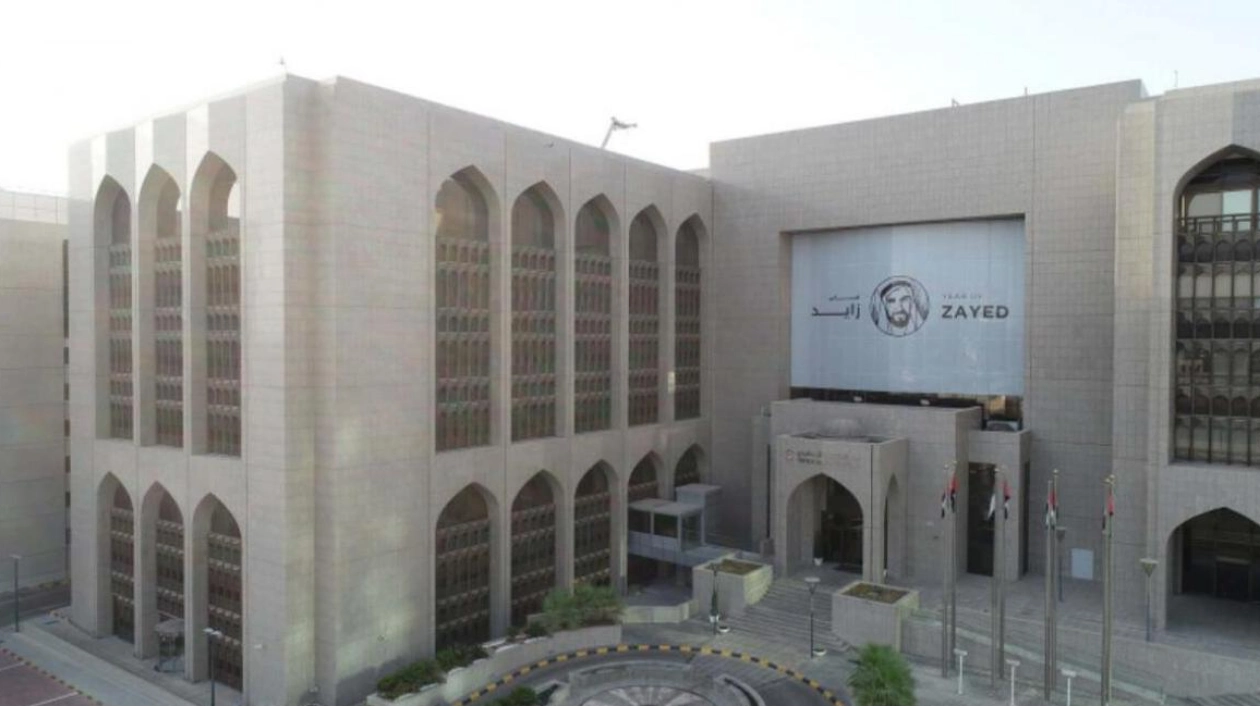

The Central Bank of the UAE (CBUAE) noted in its 2023 Financial Stability Report that the UAE benefited from favorable domestic conditions, shielding the financial system from adverse global economic trends. Khaled Mohamed Balama, Governor of the CBUAE, emphasized the importance of ongoing efforts to enhance financial infrastructure and implement robust regulatory measures to support sustainable economic growth and maintain the UAE's position as a leading financial hub.

Net income reported by listed banks in the GCC reached a new record high during Q2-2024, with aggregate net profits reaching $14.8 billion, a 2.6 per cent quarter-on-quarter growth. The y-o-y growth was also robust at 9.2 per cent compared to Q2-2023. The decline in impairments indicates improving economic health and credit quality, reflecting the improving loan portfolios over the past several years.

Net interest income reached a new peak during Q2-2024 at $21.5 billion, while non-interest income reported a small decline. Aggregate bank revenue reached $31.6 billion during Q1-2024, registering a marginal quarter-on-quarter growth of 0.4 per cent. Gross loans for UAE banks registered the strongest quarterly growth during Q2-2024 at 3.4 per cent, followed by Saudi Arabian banks with a 3.1 per cent growth.