US regulators are unlikely to finalize controversial increases in bank capital requirements before the November presidential election, raising doubts about the completion of these and other stringent draft regulations for Wall Street banks, according to five individuals knowledgeable on the matter.

The Basel III Endgame rules, which aim to reform how banks with assets exceeding $100 billion manage their capital, could potentially restrict their lending and trading activities. Banks argue that additional capital requirements are unnecessary and would harm the economy, leading to vigorous lobbying efforts to halt the Basel regulations. The fate of these efforts hinges on the November 5th election.

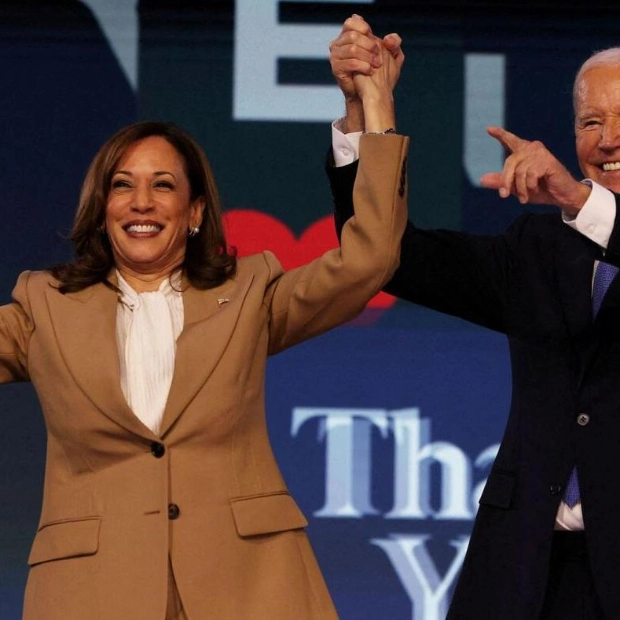

Democratic presidential candidate, Vice-President Kamala Harris, advocates for strengthening bank regulations. However, a victory for Republican candidate Donald Trump is anticipated to result in the dismantling or significant weakening of these new rules, as Trump has promised to reduce bureaucratic red tape. The candidates are in a close race, with Harris leading in some key states.

Regulators have been debating for months whether to reissue the Basel draft and allow banks to provide feedback, as reported by Reuters in June. Industry leaders widely anticipate that the rule will be re-proposed after Federal Reserve Chair Jerome Powell emphasized its necessity to Congress last month due to significant changes. It remains uncertain how the Fed will convince other agencies, which aim to finalize the rule before the election, to support this plan.

Even if an agreement is reached next month, banks would likely be given at least 60 days to offer feedback, a standard timeframe for complex rules. This would make it nearly impossible for officials to process the comments and finalize a draft before a new US administration takes office in January 2025.

This previously undisclosed timeline jeopardizes the Basel rules and two other debt and liquidity regulations for large banks, which cannot be completed until the Basel draft is finalized and the staff working on it are available. Collectively, these rules could necessitate banks to hold over $200 billion in additional capital and debt, according to regulatory estimates, potentially leading to substantial or indefinite delays that could be highly beneficial to the industry.

Progressives who support stricter rules are concerned that the extensive public campaigns by banks, costing millions of dollars, will ultimately succeed in thwarting the comprehensive regulatory overhaul they hoped for under Democratic leadership, despite last year's bank failures highlighting systemic risks.

University of Michigan professor Jeremy Kress commented that regulators were overly optimistic about the ease of implementing Basel III Endgame. Spokespeople for the Fed, Office of the Comptroller of the Currency (OCC), and Federal Deposit Insurance Corporation (FDIC) declined to comment, as did spokespeople for the Harris and Trump campaigns.

In July, Powell stated to Congress that his objective was to get the Basel rules right, rather than quickly. Several Fed officials share Powell's view that the new draft must be re-proposed, believing it would reduce the risk of Wall Street banks suing to invalidate the final rule on procedural grounds.

The OCC and FDIC oppose re-proposing, making it nearly unprecedented for them to finalize the draft without the Fed's involvement. Michael Bright, CEO of the Structured Finance Association, an industry group advocating for changes to the draft, considers it malpractice to finalize the proposal at this stage. He does not believe it will be completed before the election.

Trump could replace Acting Comptroller Michael Hsu and influence the FDIC board, which votes on rules, potentially handing control of the majority of the bank regulatory agenda to Trump appointees. Another significant draft rule, which proposes large regional banks to issue up to $70 billion in new long-term debt to mitigate potential losses, is also delayed due to its dependency on the Basel risk measurements.

Work on this rule could proceed once there is support for the final Basel draft, as Powell mentioned in July. Additionally, a plan to impose new liquidity rules on banks is also stalled due to the Basel regulations. Even if Harris wins, the anticipated appointment of FDIC chair nominee Christy Goldsmith Romero could further delay the rules, and if the Senate shifts to Republican control, political pressure to weaken the rules could intensify.

Bright concluded, "There are a whole lot of things up in the air."