Last week saw a decrease in the number of Americans applying for new unemployment benefits, reaching a one-month low. This suggests that the labor market is slowing in an orderly manner, contrary to financial market expectations that the Federal Reserve might reduce interest rates by 50 basis points next month. This economic resilience was further supported by data showing a significant increase in retail sales for July, the highest in nearly one and a half years.

Investors had been anxious following a rise in the unemployment rate to a near three-year high of 4.3 percent in July, which raised concerns about an economic recession or impending downturn. However, most economists do not share these fears. Christopher Rupkey, chief economist at FWDBONDS, noted, "Fed officials need not be overly concerned about the economic outlook as the risks are diminishing rapidly with fewer job layoffs and strong consumer spending. The economy is not derailing."

The Labor Department reported that initial claims for state unemployment benefits fell by 7,000 to a seasonally adjusted 227,000 for the week ending August 10. This was lower than the 235,000 claims forecasted by economists polled by Reuters. The second consecutive weekly decline reversed the increase seen in late July, which had pushed claims to an 11-month high. The rise in claims last month was attributed to temporary shutdowns at motor vehicle plants and disruptions caused by Hurricane Beryl in Texas.

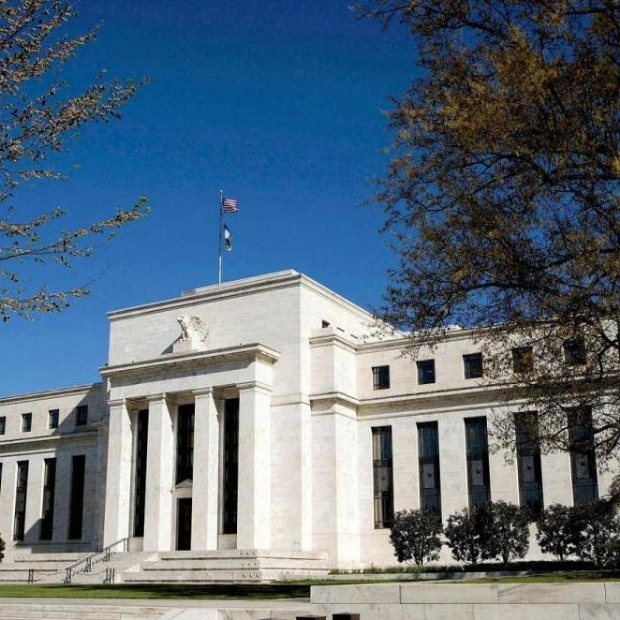

The labor market is indeed slowing as businesses reduce hiring to match the increase in labor supply due to immigration. The Federal Reserve's rate hikes totaling 525 basis points in 2022 and 2023 are helping to curb demand. Financial markets now see a lower likelihood of a half-percentage-point rate cut at the Fed's September policy meeting, with odds dropping to 27.5 percent from 41.5 percent before the latest data.

The Fed has kept its benchmark overnight interest rate within the current 5.25 percent to 5.50 percent range for a year. The dollar strengthened against a basket of currencies following the data release, while Treasury prices declined. The number of people receiving benefits after an initial week of aid, a proxy for hiring, decreased by 7,000 to a seasonally adjusted 1.864 million for the week ending August 3.

A separate report from the Commerce Department's Census Bureau indicated that retail sales surged by 1.0 percent in July, marking the largest increase since January 2023, following a revised 0.2 percent drop in June. Retail sales rose 2.7 percent year-on-year in July, with consumers continuing to spend through bargain hunting and opting for lower-priced alternatives. Sales in various sectors, including motor vehicles, online stores, and building materials, showed significant increases.