In May, Volkswagen's finance chief Arno Antlitz cautioned that Europe's leading automaker had approximately two to three years to ready itself for intense competition from abroad, primarily from China. Last week, he shortened this already compressed timeline by a year, sending ripples through the global automotive industry by threatening to close plants in the company's home market for the first time. While many of Volkswagen's challenges—ranging from a weakening Chinese market to a slower-than-expected transition to electric vehicles—have been ongoing, two recent developments have exacerbated the situation for the German conglomerate, according to interviews with seven company insiders, investors, and analysts.

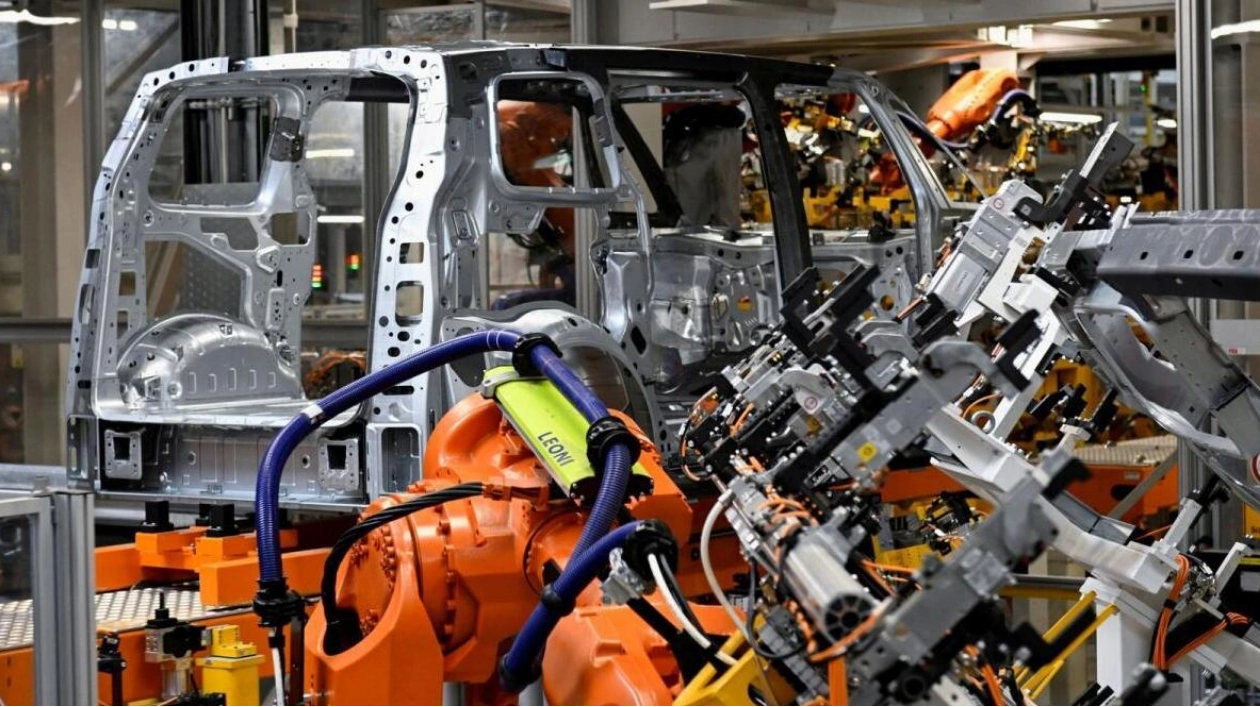

First, there is growing concern that Asian competitors, including BYD, Chery, and Leapmotor, might accelerate their plans to establish production capacity in Europe if Brussels proceeds with proposed hefty import tariffs on Chinese-made EVs. Second, Volkswagen recently slashed prices for VW brand cars to counter fiercer competition, a move that, according to works council head Daniela Cavallo, has cost the company hundreds of millions of euros in profits. The discounts were steeper than initially anticipated and convinced management that the high cost base in Germany is undermining Volkswagen's ability to compete with more nimble rivals, a company source revealed, without specifying the extent of the price cuts. The source requested anonymity due to the sensitivity of the issue. Volkswagen declined to comment.

"This is one of the world's largest car manufacturers that is not generating substantial returns from its scale," said Cole Smead, CEO of Volkswagen shareholder Smead Capital Management. "Do I believe they can sustain that level of production in a country that demands so little? It's impossible." These discounts, combined with restructuring costs, have hindered the VW brand's efforts to cut costs by over 10 billion euros ($11 billion) by 2026. Consequently, the VW passenger car brand's profit margin plummeted to 0.9 percent in the second quarter, down from a meager 4 percent in the first. By contrast, margins at Renault and Stellantis, the other major European volume carmakers, stood at 8.1 percent and 10 percent respectively in the first half of the year.

Volkswagen's squeezed margins—amidst increased imports from Chinese rivals into Europe—have heightened fears of what might occur when these rivals begin local production. After all, carmakers—including the Chinese—are vying for a smaller slice of the pie: Europe's car market is 13 percent, or two million vehicles, smaller than pre-pandemic levels, CFO Antlitz noted. Citing these myriad challenges, DZ Bank analyst Michael Punzet anticipates that Volkswagen will once again lower its full-year group margin target when it releases third-quarter results. The company already reduced the target to 6.5-7.0 percent in July due to provisions related to the potential closure of a Brussels factory operated by luxury subsidiary Audi.

As demand wanes, selling mass-market cars has evolved into a battle over cost efficiency. "The era of seeking solutions through growth is over. Everyone is losing market share, and companies must adapt," said Jefferies analyst Philippe Houchois. Antlitz stated this week that the VW brand—which accounted for over half of group production last year—has been spending more than it earns for some time, adding that the company will not succeed if this trend persists. Volkswagen's automotive cash flow, a critical indicator of operational health, turned negative in the first half of 2024, reaching minus 100 million euros, compared to a positive 2.5 billion in the same period the previous year. Intense competition is not confined to the domestic market.

Profits from China, Volkswagen's largest single market, have nearly halved over the past decade to 2.6 billion euros in 2023. Expected to rise to around 3 billion euros by 2030, they will barely recover. Another significant issue is energy and labor costs in Germany, which are among the highest in Europe and have also become a major concern for the country's chemical and steel sectors. "New, cheaper competition, higher energy prices, and high labor costs all converge to create a very challenging outlook, particularly for European mass brands," Citi analysts noted this week.