Canceling insurance always sounds easier than it feels. On paper, Progressive lets you cancel at any time. In real life, details matter. Timing, state rules, replacement coverage, and even how you cancel can affect refunds, fees, or whether your policy actually ends when you expect it to.

This guide explains how canceling Progressive insurance really works. No sales language, no scare tactics. Just the practical steps, what to check before you cancel, and how to make sure you don’t end up uninsured or stuck with an extra bill later.

Can You Cancel Progressive Insurance at Any Time?

Yes. Progressive allows policyholders to cancel at any point, even if the policy just started. You do not need to wait until the end of your policy term, and you do not need a special reason to cancel.

That said, the ability to cancel does not mean there are no consequences. Depending on your state and policy type, canceling early may trigger a cancellation fee. If you prepaid your premium, you will usually receive a prorated refund, minus any applicable fees.

The key takeaway is simple: cancellation is allowed, but the financial outcome depends on timing, state rules, and how your policy is structured.

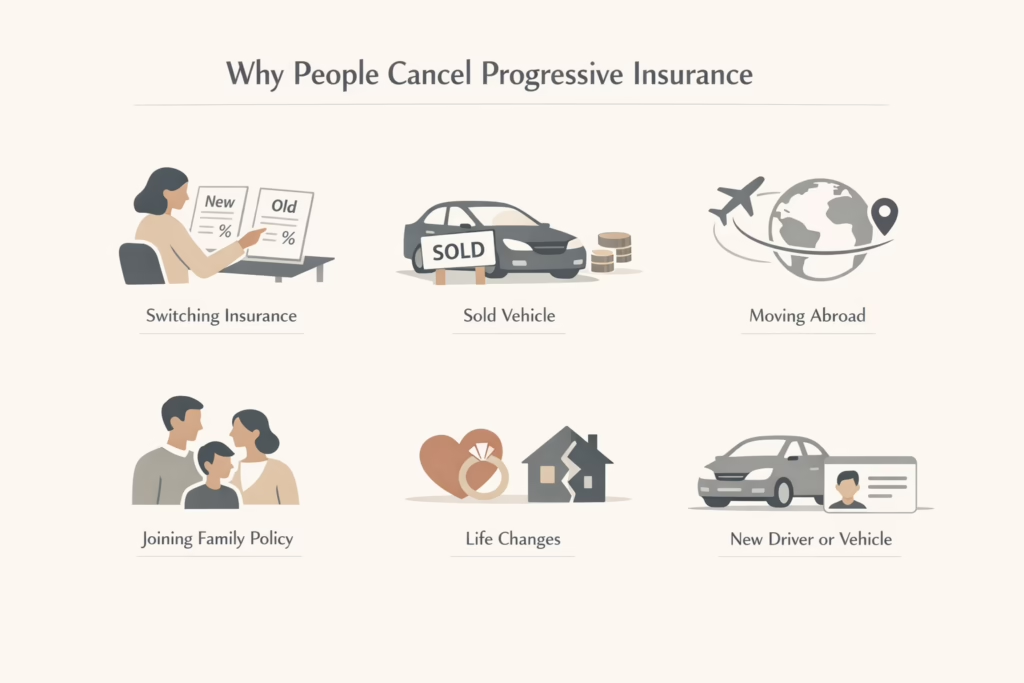

Why People Cancel Progressive Insurance

Most cancellations fall into a few predictable categories. None of them are unusual, and Progressive deals with these situations every day.

Common reasons include:

- Switching to another insurance company after comparing rates

- Selling a vehicle and no longer needing coverage

- Moving out of the country

- Being added to a spouse or family member’s policy

- Major life changes such as marriage, divorce, or buying a home

- Adding a new driver or vehicle that changes the cost of coverage

One thing worth clearing up early is this: selling a car does not automatically mean you should cancel your policy. If you are replacing the vehicle or plan to buy another one soon, updating the policy is often the simpler and safer option.

Why Replacement Coverage Matters More Than People Think

This is where many cancellations go wrong.

In nearly every U.S. state, drivers are legally required to maintain minimum liability coverage. Canceling your Progressive policy without having another active policy in place can create a coverage gap. Even a short gap can cause problems, including fines, license issues, or higher premiums later.

If your vehicle is financed or leased, the requirements are stricter. Lenders typically require comprehensive and collision coverage. Canceling without meeting those requirements can violate your loan or lease agreement.

The safest approach is to line up your new policy first and schedule it to start on the same date your Progressive policy ends. That alignment avoids gaps and eliminates guesswork.

When Is the Best Time to Cancel?

There is no universal best day, but there are smarter windows.

Many people review their insurance three to four weeks before renewal. That timing gives you room to compare rates, confirm new coverage, and cancel without pressure. Progressive usually sends renewal notices ahead of time, which makes planning easier.

Another common moment is after a major life change. Moving, adding a driver, or changing vehicles often triggers a rate adjustment. That can be a good opportunity to reassess whether Progressive still fits your needs.

Canceling mid-term is allowed, but it increases the likelihood of fees. If timing is flexible, canceling closer to renewal can reduce friction.

Will Progressive Charge a Cancellation Fee?

Sometimes, yes.

Cancellation fees are regulated at the state level, so there is no single rule that applies everywhere. In some states, there is no fee at all. In others, the fee may be a percentage of the remaining premium.

If you prepaid your policy, Progressive typically refunds the unused portion after subtracting any applicable fees. If you pay monthly, the final bill usually reflects only what is owed up to the cancellation date.

The best way to avoid surprises is to review your policy documents or contact Progressive directly before canceling. Guessing is how people end up confused by final bills.

How Refunds Work After Cancellation

Refunds are usually prorated. That means you get back the portion of your premium that covers unused time on the policy.

Refund timing varies. Some refunds process within a few business days. Others may take longer, especially if the policy involved multiple coverages or bundled products.

One detail that catches people off guard is payment method. Refunds often go back to the original payment source. If that account is closed, delayed refunds are more likely.

Ways to Cancel Progressive Insurance

Progressive offers several cancellation methods, but availability depends on state laws and policy type.

1. Canceling by Phone

Calling Progressive is one of the most reliable options. A representative can confirm your policy details, explain any fees, and process the cancellation. You may still need to sign a document in some states, but the call clarifies what comes next.

Expect retention questions. That is standard. A clear, polite statement that you have already arranged replacement coverage usually keeps the conversation short.

2. Canceling Online

Some policyholders can cancel directly through their online account. Others will find that online cancellation is not available in their state.

If the option exists, it is usually straightforward. Just be sure to reach the final confirmation screen. Closing the browser early does not always complete the process.

3. Canceling by Mail

Certain states require written cancellation. In those cases, you may need to mail a signed cancellation request.

A basic cancellation letter should include your policy number, the requested cancellation date, your contact information, and your signature. Mailing it at least one to two weeks in advance gives time for processing.

What to Include in a Written Cancellation Request

If you are canceling by mail, clarity matters.

Include your full name, address, phone number, and policy number. Specify the exact date and time you want the policy to end. If you already have replacement coverage, include the new insurer’s name and policy start date if required by your state.

Sign and date the letter. Unsigned requests are a common reason for delays.

Can a New Insurer Cancel Progressive for You?

Sometimes.

Some insurance companies and independent agents will handle the cancellation of your old policy as part of onboarding. This usually involves signing a cancellation authorization form.

Even if they offer this service, do not assume it is complete until you receive confirmation from Progressive. Ultimately, you are responsible for making sure the policy actually ends.

What Happens After You Cancel Progressive Insurance?

Canceling a policy does not delete your account. Your information remains on file, and you can reactivate coverage later if you choose.

You should receive a cancellation confirmation. Keep it. This document matters if billing disputes or coverage questions come up later.

Refunds, if applicable, are processed separately. Do not confuse cancellation confirmation with refund confirmation. They are not the same thing.

Common Mistakes That Cause Problems

Most cancellation issues stem from a few predictable errors. They are easy to avoid once you know where people usually slip up.

- Canceling before new coverage starts: This is the most common mistake. Even a short gap in coverage can lead to legal issues or higher premiums later.

- Assuming a discount offer means cancellation: If Progressive shows a discount or retention offer and you exit the page without confirming, the policy often remains active.

- Forgetting about bundled policies: Canceling auto insurance does not cancel home, renters, or other linked policies. Each one must be handled separately.

What If Charges Continue After Cancellation?

First, check your cancellation confirmation and the effective date. Many charges come down to timing, not errors.

If the charge is incorrect, contact Progressive with your confirmation details. Billing issues are easier to resolve when you have documentation.

Do not ignore unexplained charges. Insurance billing does not fix itself.

How State Laws Affect Progressive Cancellations

Insurance is regulated at the state level. That is why cancellation rules vary.

Some states require written notice. Others allow phone or online cancellation. Fees, refund rules, and proof-of-coverage requirements also differ.

If something about your cancellation process seems inconsistent, it is likely a state rule rather than a Progressive policy choice.

Should You Cancel or Adjust Your Policy Instead?

Not every situation calls for cancellation.

If you are changing vehicles, moving within the same state, or adjusting coverage limits, updating the policy may be easier and cheaper than canceling and restarting elsewhere.

Cancellation makes sense when you are leaving the insurer entirely or no longer need the coverage type. Otherwise, a policy update is often the cleaner solution.

Wrapping It Up

Canceling Progressive insurance is not difficult, but it is rarely as simple as clicking one button and walking away. Timing, replacement coverage, and state rules all play a role in how smooth the process feels.

If you line up new coverage first, confirm your cancellation method, and keep written proof, the process is usually uneventful. Problems tend to appear only when steps are rushed or assumptions are made.

Insurance cancellations are about details. Pay attention to them, and you avoid the stress that so many people associate with the process.

Frequently Asked Questions

Can I cancel Progressive insurance at any time?

Yes. Progressive allows you to cancel your policy at any point, even if it recently started. You do not have to wait until the policy term ends. Just be aware that timing can affect refunds or cancellation fees.

Is there a cancellation fee if I end my policy early?

It depends on your state and policy type. Some states allow cancellation fees, while others do not. If a fee applies, it is usually deducted from any unused premium you are owed.

Will I get a refund after canceling Progressive insurance?

If you paid your premium in advance, you will usually receive a prorated refund for the unused portion of the policy. Any applicable cancellation fees may be subtracted from that amount.

Do I need new insurance before canceling Progressive?

In most cases, yes. Nearly all states require drivers to carry liability insurance. Canceling without replacement coverage can lead to legal issues or higher rates later. If your vehicle is financed or leased, replacement coverage is essential.

Can I cancel Progressive insurance online?

Some policyholders can cancel through their online account, but availability depends on state laws. If online cancellation is not available, you may need to call or submit a written request.