On Thursday, the Abu Dhabi Securities Exchange (ADX) revealed the secondary listing of the $2.5 billion bond issued by the Abu Dhabi Development Holding Company (ADQ), which was initially listed on the London Stock Exchange (LSE) in April 2024.

This dual tranche bond, consisting of a $1.25 billion five-year tranche and a $1.25 billion ten-year tranche, highlights ADX's role as a versatile capital market and a vibrant platform for global investors. The bond offering attracted substantial interest from both local and international investors, resulting in a 4.4 times oversubscription.

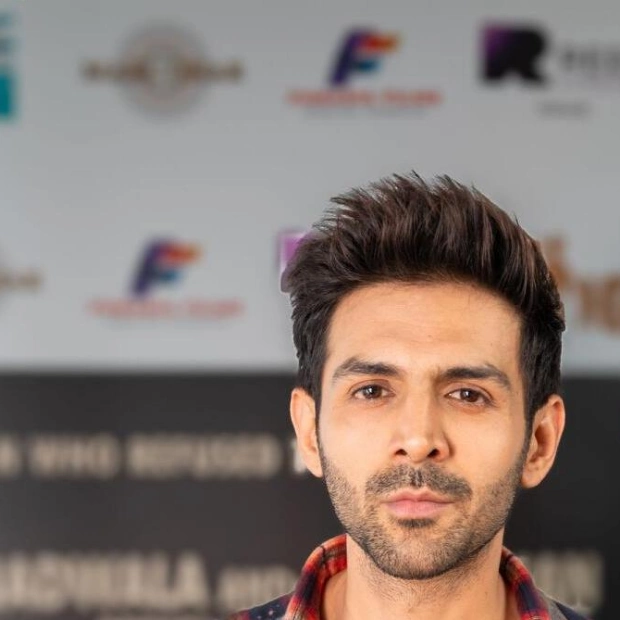

Abdulla Salem Alnuaimi, Group CEO of ADX, stated, "ADX is committed to offering a flexible and dynamic investment platform and market infrastructure to help entities like ADQ meet their goals and advance Abu Dhabi's economic diversification strategy."

As an asset owner tasked with supporting the sustainable growth of Abu Dhabi's economy, ADQ assists its portfolio companies in preparing for future listings to enhance their funding structures and maintain top-tier corporate governance. As of July 2024, ADQ's portfolio includes eight companies listed on ADX: Taqa, AD Ports Group, Agthia Group, Emirates Steel Arkan, PureHealth, E7 Group, Modon Holding, and Abu Dhabi Aviation. This latest listing brings the total number of debt instruments on ADX to 60.