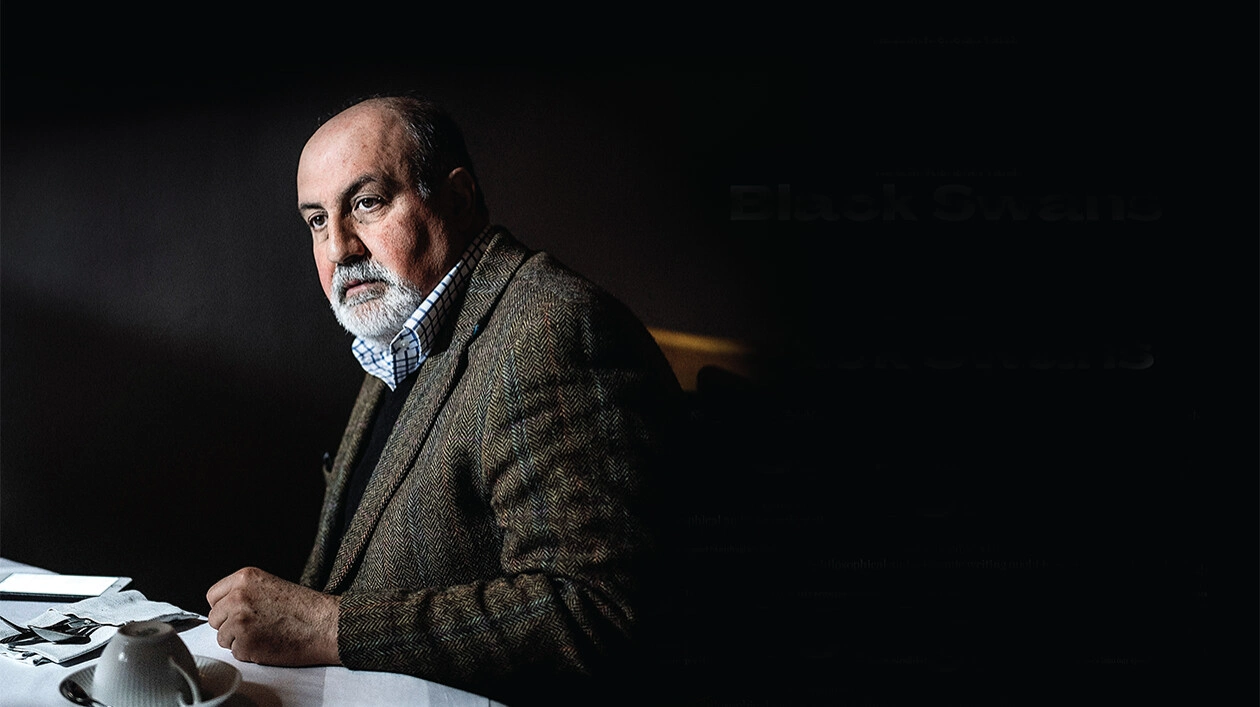

With all sorts of statistics gathered, various research conducted, and huge budgets allocated for anti-crisis programmes worldwide, banks, nevertheless, keep collapsing, aircraft still crash down every now and again, and earthquakes remain totally unpredictable. So, all of a sudden, we hear the shocking news: stats do not work, normality is overestimated, and the world is ruled by The Black Swans, always appearing out of the blue. Our new columnist Nassim Nicholas Taleb, Doctor of Economics, MBA, an essayist, teacher, philosopher, and statistician, discourses on fragility having no opposite.

Some things and phenomena belong to a general system I term ‘Antifragility’. Disorder and shake-ups, destroying the fragile, are beneficial to them, so they blossom and develop from volatility, contingency, confusion, stress, love fever, risks, and uncertainty. Our Grandmas were once well-aware of that, and it is still common knowledge actually. But not for ‘experts’, so I call them pseudo-experts. Let’s talk about what’s going on in the modern world. I’ve been studying the so-called ‘The Black Swan Effect’ that seems to be just beyond our comprehension. I’ve written a 650-page book to explain why The Black Swans are unpredictable. So, rather than waste time, trying to second-guess them, we’d better be focusing on protecting ourselves from them by building systems, enabling us to cope with extreme events we cannot possibly foresee.

The problem of our analysis lies in our looking back while recalculating, which entails an inevitable misunderstanding of the present and failing to forecast the future. The Black Swans’ malicious jest at our minds is making us believe that we ‘sort of’ or ‘almost’ did predict them, as retrospectively, they are quite explainable. That only causes more crashes, forest fires, and what not just because we think we know more than what really happens. That’s what the problem with ‘experts’ is. Trying to analyse events, their causes, and see how the local valences can influence the general effects, they just overestimate their ‘expertise’.

My new book, to be released in many countries next year, is about our inability to understand group behaviour, proceeding from the knowledge of group members. You might as well know how an ant behaves, but you will never be able to figure out what determines the behaviour of the whole ant hill. In the meanwhile, you cannot rely on the psychological testing of individuals, private entrepreneurs, or agents. It’s wrong to assume, ‘OK, they make such and such mistakes, so let’s apply these conclusions to the whole market’. While any individual can behave irrationally, the market can still remain rational. The confusion is caused by the fact that different levels are different systems, so even knowing their parts, you still cannot grasp how they work together. The problem is that there’s no way to foretell a crisis on the basis of the visible and the conclusions drawn from the past. That’s not bad news though. What we need is to work out what the subsystems are all about, and how they function. And just go on living, knowing The Black Swans are beyond prediction.

The abovementioned can be observed in politics and economies. If you fall off a bicycle, you get hurt. You know from experience how the bicycle works, and how painful falls are. In the meantime, some people can gain from others’ fragility. If you run a political process or a bank, your mistakes impact others but not you. So, it being none of your concern, you’ve got nothing to worry about. A bad pilot perishes together with his aircraft, while an incompetent politician or economist, inflicting damage to whole countries, remains alive and kicking. That’s what is happening for the most part nowadays. ‘Dear investors, just like us, you are surely shocked by today’s events’. That’s what I call ‘The Robert E. Rubin Deal’. Robert E. Rubin served as a US Secretary of the Treasury, so you might have seen his signature on dollar banknotes. After working for the US Government, he went into the private financial sector and landed a dream job of a Citibank Executive. The changes encouraged by him led the bank to the crash of 2008, and all its president had to say was, ‘Black Swan, you know’. Fragility ends in The Black Swan of The Robert E. Rubin Deal. Incompetence, pseudo-expertise, and use of others’ fragility are the three main ingredients of a recipe for a guaranteed disaster.

Gigantic mortgage agency Fannie Mae has already deprived the American taxpayers of many hundreds of Millard’s of dollars, and the figure still keeps growing. In 2003, I found proof of the company’s financial vulnerability. My report about its super-fragility, published in The New York Times, caused very strange protests from other financial and banking institutions, so I concluded that all of them were in the same ballpark, and a major collapse was inevitable. When my predictions came true, my methodology, based on judging not by the traditional risk assessment but the company’s fragility profile was finally adopted by the IMF despite the pseudo-experts’ terming it ‘trivial’.

So, pseudo-experts are in the wrong. The fragile cannot be saved by forecasting. A coffee cup, for one, is sure to be smashed to pieces by an earthquake that cannot possibly be predicted. The Japanese are used to it and even have a special word – ‘Kintsukuroi’ – denoting an increased value of a damaged object, thus emphasising the benefit of being broken. The pieces are stuck together with gold, and the smashed thing is made whole again. If we can mend it and accept it in its new incarnation, we are already on the right track. Nonetheless, it’s still far from being the opposite of fragility.

The Ancient Greeks were good at coining words and phrases to describe phenomena. So, they certainly had a vivid image, illustrating fragility too - The Sword of Damocles, hanging over his head, ready to kill him any moment. Such is the fate of the companies that are not going up, so theirs is the way down in flames. Nobody knows exactly when it will happen, but fragility being their middle name, it’s written in the stars for them.

Another ancient metaphor, describing something counterposing fragility, though, not its opposite either, is Phoenix, returning to life from the ashes. At that, it does not become any better or worse than its predecessor. All it can do is arise after a total collapse. It, too, brings us closer to finding a solution.

There’s also The Hydra that would regrow two heads for every one chopped off, all the while becoming hard as nails, fierce, nasty, dexterous, and extremely perilous for you. Or you yourself become more dangerous and less fragile if you yourself are The Hydra.

Mithridates, King of Pontus, taking poison in small portions all his life to become poison-proof, is somewhere between Phoenix and The Hydra, yet not quite the latter. Unable to prevent an attempt to poison him, Mithridates was still able to become Antifragile in this respect.

Antifragility loves contingency and uncertainty, which means love for mistakes of a certain kind – its key feature. The unique character of Antifragility lies in letting us deal with the unknown, act without realising what we’re doing, and hit it big anyway. Let me make it straight: by and large, it is thanks to Antifragility that we are good at doing things rather than at pondering on something. Under any circumstances, I’d rather be dull and Antifragile than sharp and fragile. So, first and foremost, down with any pseudo-expertise! You must become Antifragile, fall in love with the unpredictable, and start worshipping chaos. And take some simple measures: avoid debt obligations, making your system fragile, make some funds superfluous, and do your best to do without optimisation. These are must-dos, even though all that contradicting ‘The Portfolio Theory’, a financier finds it really hard to grasp. I have always been skeptical about any form of optimisation, as in The Black Swan World, it’s just impossible. The best you can do is lessen your fragility by strengthening your substantiality. And remember that Antifragility is the antidote for The Black Swans.